Climate Risk Index for the Australian energy sector

20.02.2024 - 03:14

Mandala Partners (Mandala) in conjunction with Zurich Financial Services Australia (Zurich) has produced Australia’s first Climate Risk Index for the national energy generation sector. This report highlights the growing risk of climate change to the grid, how that risk is spread across the grid, and high-level options for mitigating those risks. More than 25% of Australia’s power generation assets are in the three highest categories for climate change risk.

"Australia’s energy generation assets underpin almost every aspect of economic and social interaction in the 21st century, however, much of the focus to date has centered on the risk of the energy grid to climate change, rather than on the risk of climate change to the grid."

- Justin Delaney, Chief Executive Officer, Zurich Australia & New Zealand

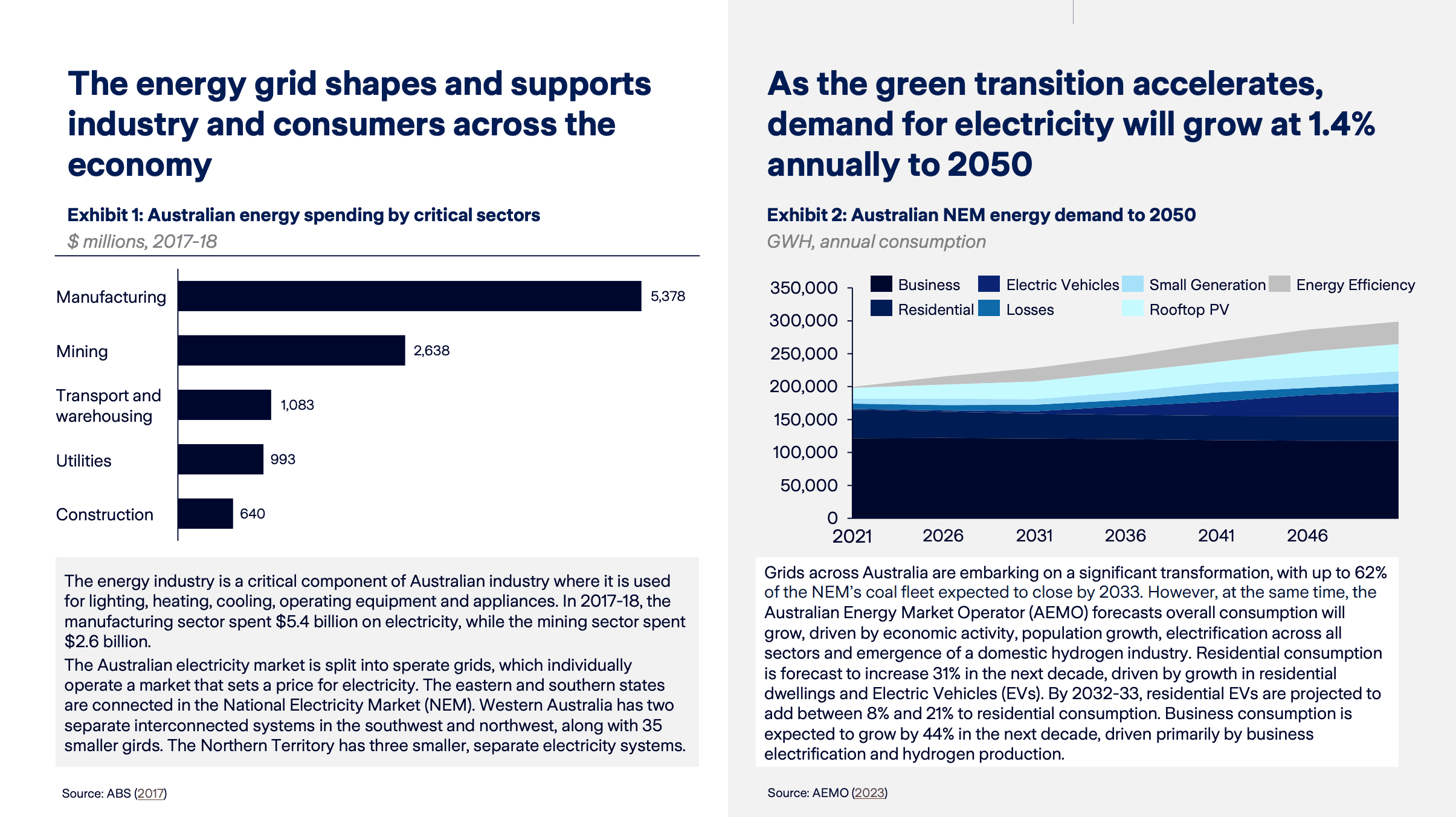

The Australian energy grid is critical to industry, consumers and the green transition

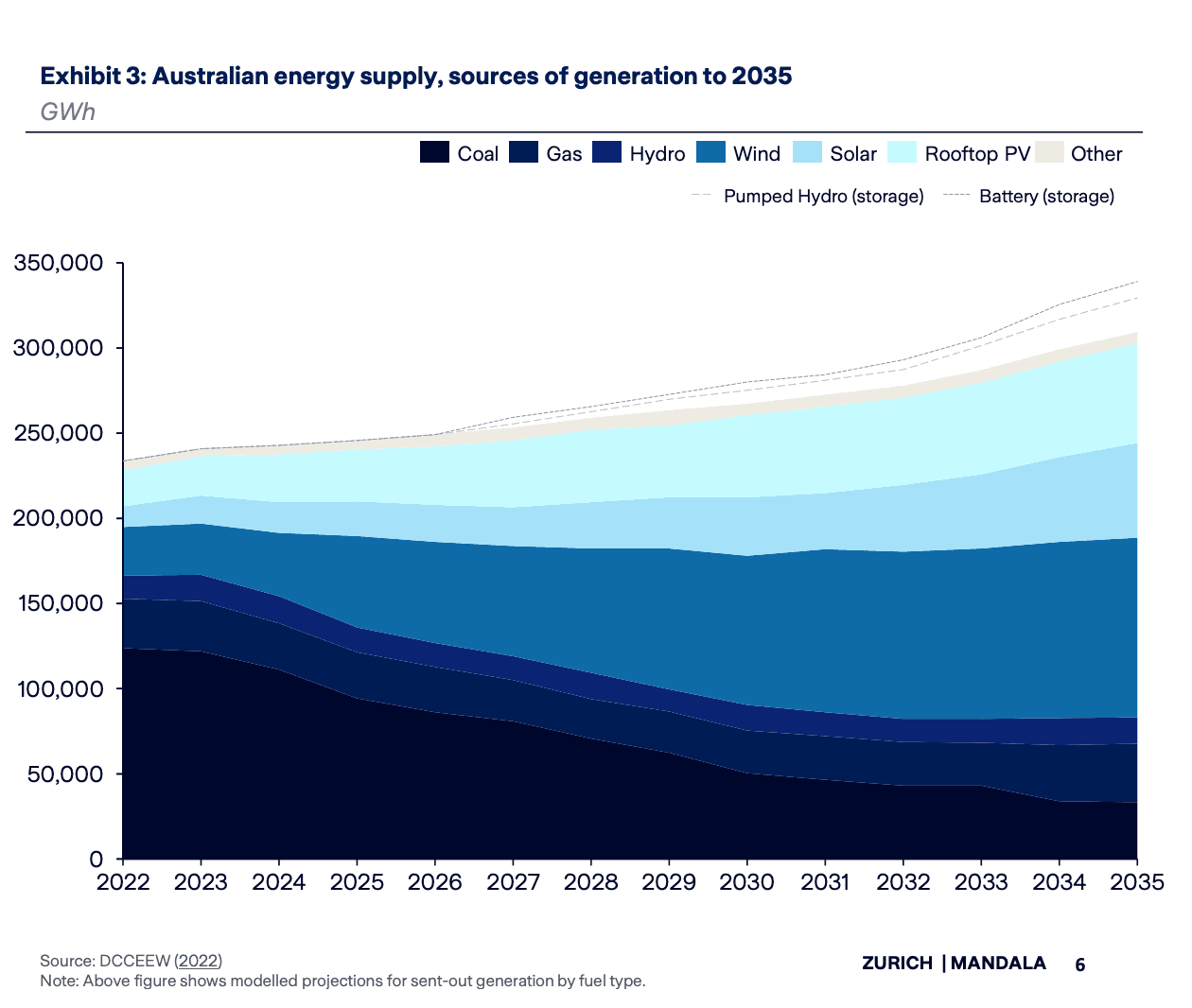

The last decade of energy policy has focused on transitioning to renewable energy sources and reducing prices for consumers. While prices have steadily climbed during this period, policies to transition the Australian grid have been fruitful.

During this period, the capacity of electricity generation from renewable sources has increased 215% from 26,700 GWh of generation in 2011-12 to 84,000 GWh in 2021-22. Under the Renewable Energy Target, this transition is required to accelerate with the goal to boost renewables to 82% of the grid by 2030.

This transition has been supported by the Australian Government’s green bank, the Clean Energy Finance Corporation (CEFC), which has invested more than $12.7 billion in large-scale renewable and transmission-related projects during the last 10 years.

The Australian Government’s October 2022-23 budget included $20 billion for its ‘Rewire the Nation’ program, a National Reconstruction Fund of $15 billion and the Powering the Regions Fund of $1.9 billion. Likewise, state governments have made numerous significant investments in energy infrastructure including renewable projects, transmission upgrades, storage capabilities and jobs plans.

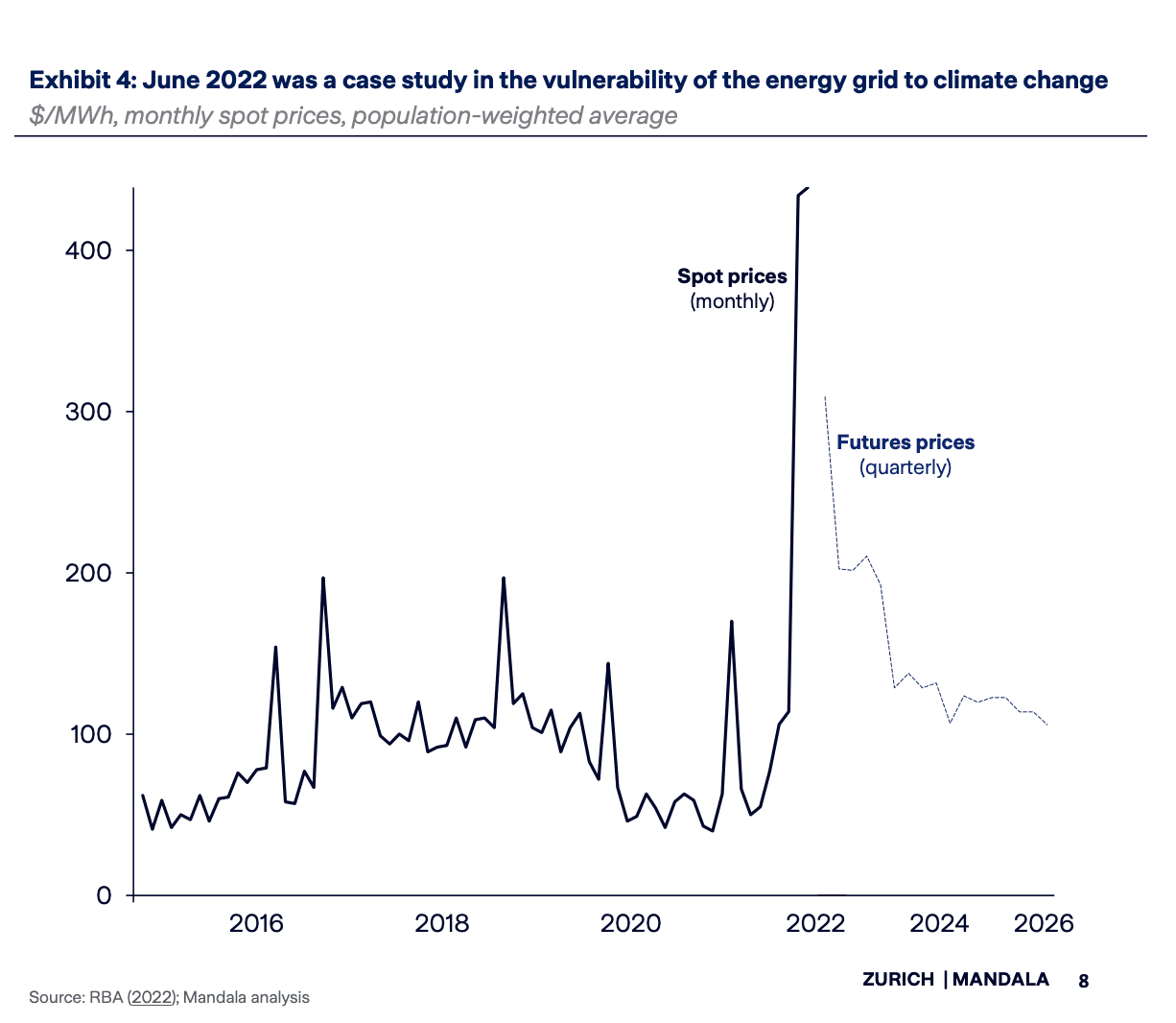

Climate affects the stability and efficiency of the grid, leaving Australia vulnerable to growing climate risk

In June 2022, the monthly average spot price for electricity hit above $350/MWh. In response, the Australian Energy Market Operator (AEMO) suspended the entire National Electricity Market (NEM), declaring the spot market had become “impossible to operate”.

June 2022 was a case study in the vulnerability of the energy grid, showing how a system already disrupted by global factors can be tipped into chaos due to climate-related factors.

Driven by Russia’s invasion of Ukraine, demand and prices for thermal coal sharply increased. Other coal generators faced further disruption due to staff shortages and the impacts of La Niña on coal production. Lower-than expected power generation from renewables also contributed to the overall price increase as adverse weather reduced the efficiency of solar generation. Meanwhile, total demand from the NEM was higher than in previous years. Exceptional rainfall and a series of cold fronts had impacted Queensland and Victoria and led to relatively high total demand from the period.

As these factors drove up prices, the AEMO implemented a price cap for a few days. This led to generators withdrawing from the market and caused the AEMO to suspend the NEM.

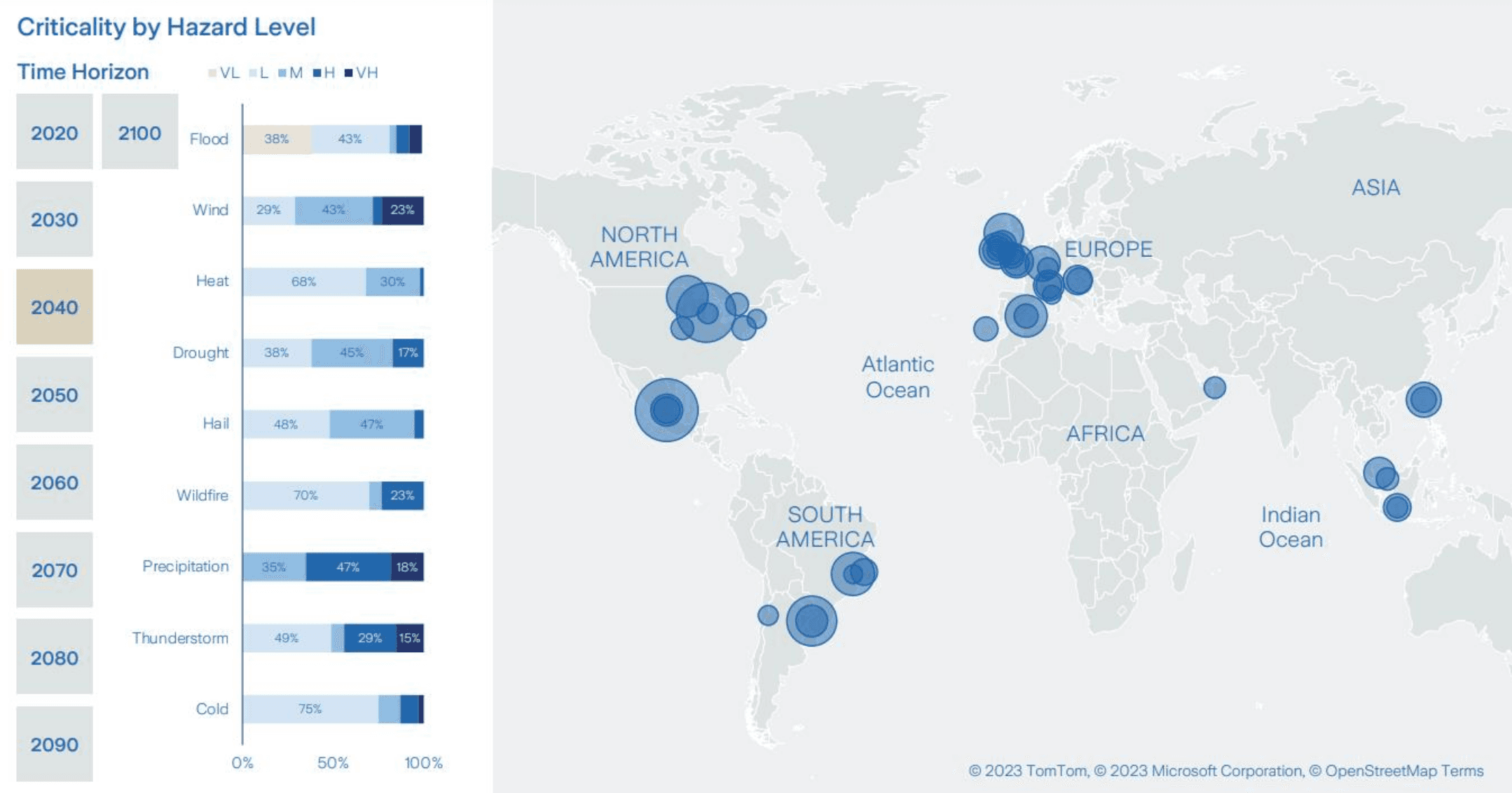

Zurich Resilience Solutions (ZRS) provides insights and solutions to help organisations proactively manage and build resilience to traditional and evolving risks, such as climate change and cyber

ZRS global exposure analysis transforms location or asset data into deep climate risk insights. Through a customised and interactive dashboard, businesses and asset owners can understand the probability that climate risks – such as heat, flood and fire – may impact a specific asset or portfolio of locations over different time horizons using three IPCC-based climate scenarios. These insights quantify and contextualise climate exposure to ensure risk can be understood, tracked and shared in order to appropriately prioritise actions and investments.

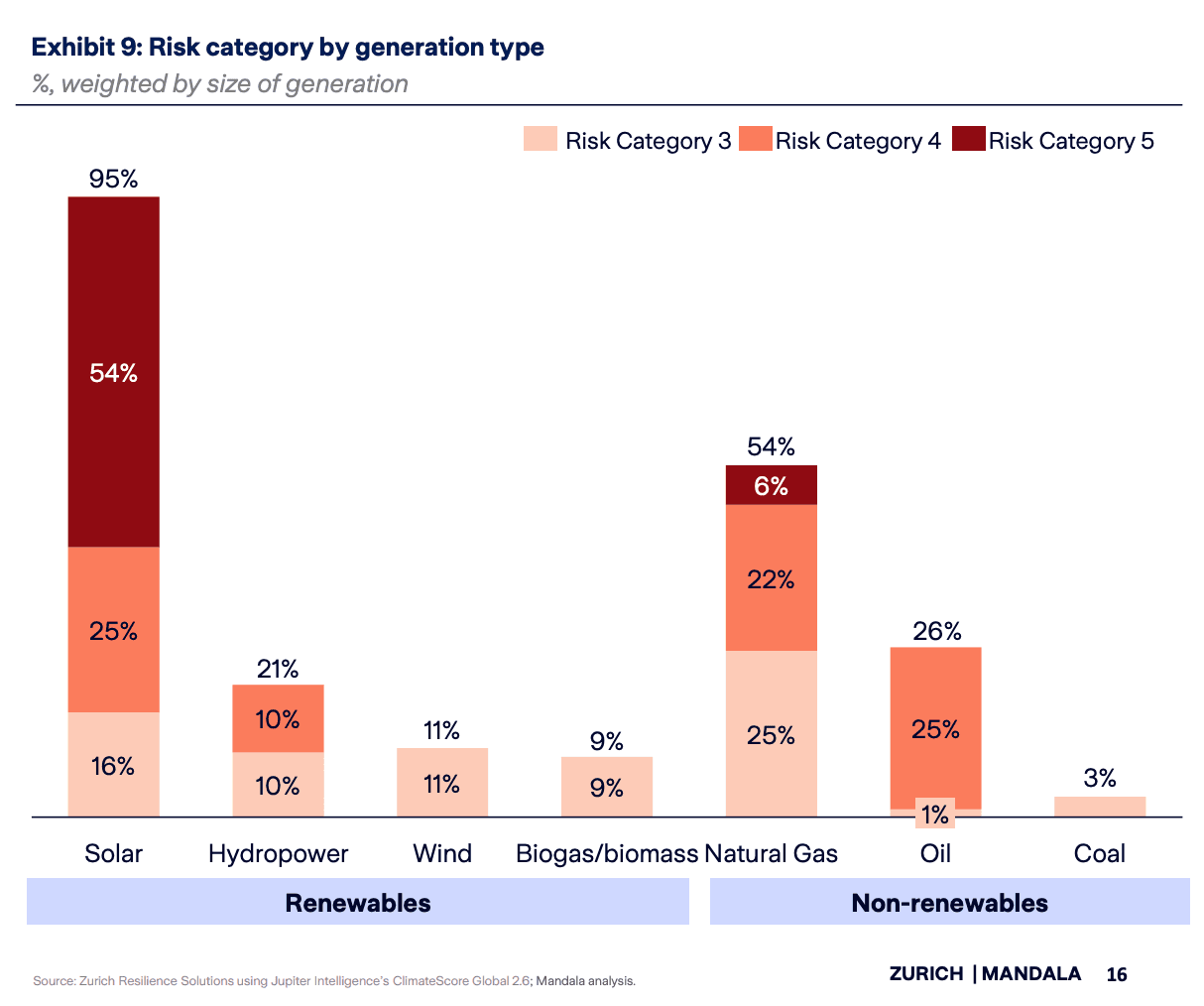

Solar generation is currently most consistently at risk, while coal and biomass are least at risk across Australia

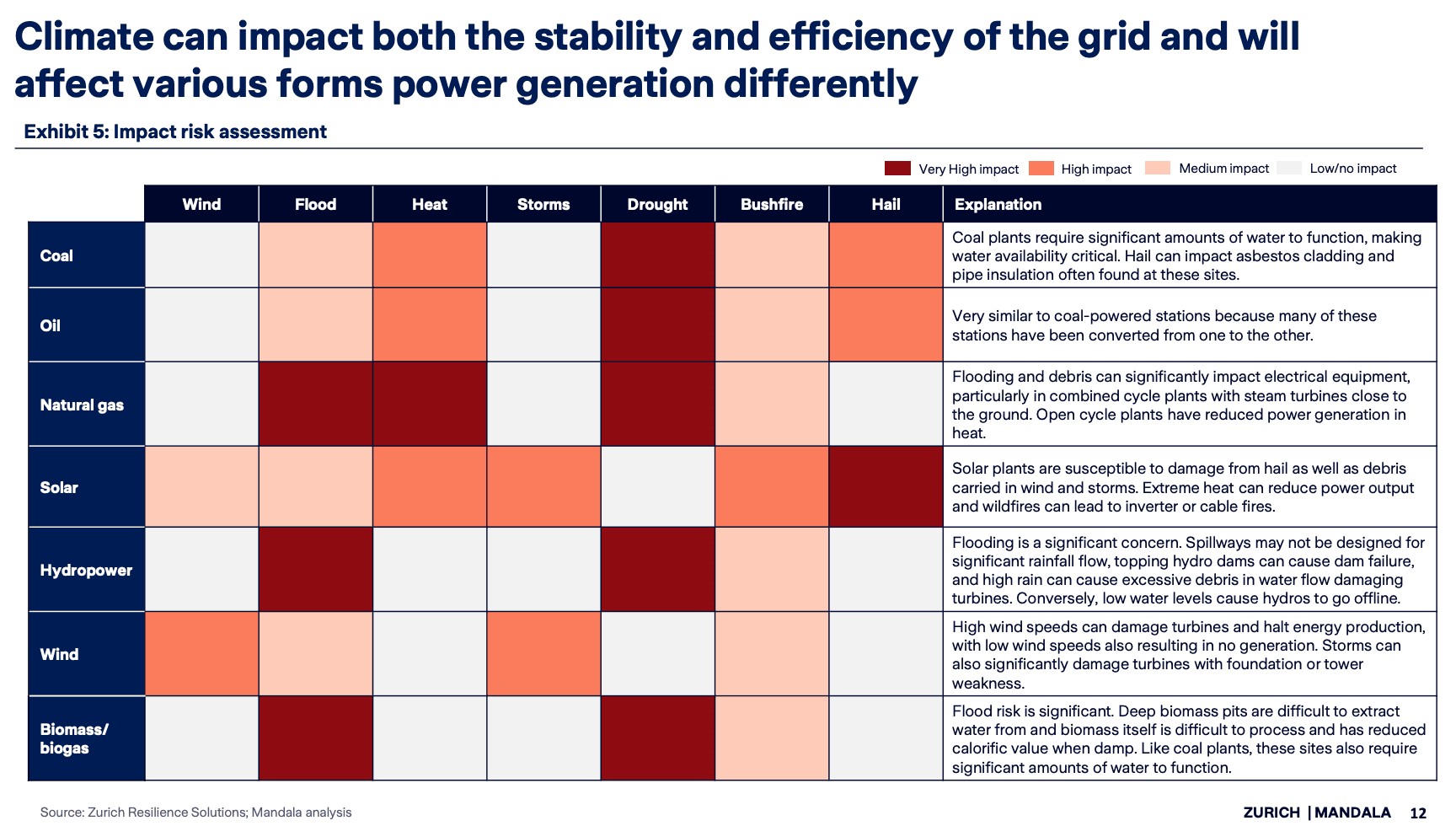

The risk posed by climate perils varies significantly by generation type. Based on the location of current generation sites, solar and natural gas face the highest risk.

The Zurich-Mandala Index found that 95% of solar generation sites were in the three highest risk categories, with 54% in the highest category. This reflects the relative vulnerability of solar panels to numerous perils. Note that this analysis does not include rooftop solar as no granular data is available on its locations. This means that overall risk for solar generation may be more diversified.

The second most at-risk generation types were natural gas and oil, which were found to have 54% and 26% of their generation respectively in risk category 3 and above. This result has been driven by the susceptibility of these generation types to perils such as high temperatures and drought.

Other forms of renewable energy like wind and biogas/biomass sat alongside coal with relatively low risk. A minimal number of these sites were in the highest three categories and less than 1% of generation were in risk categories 4 and 5.

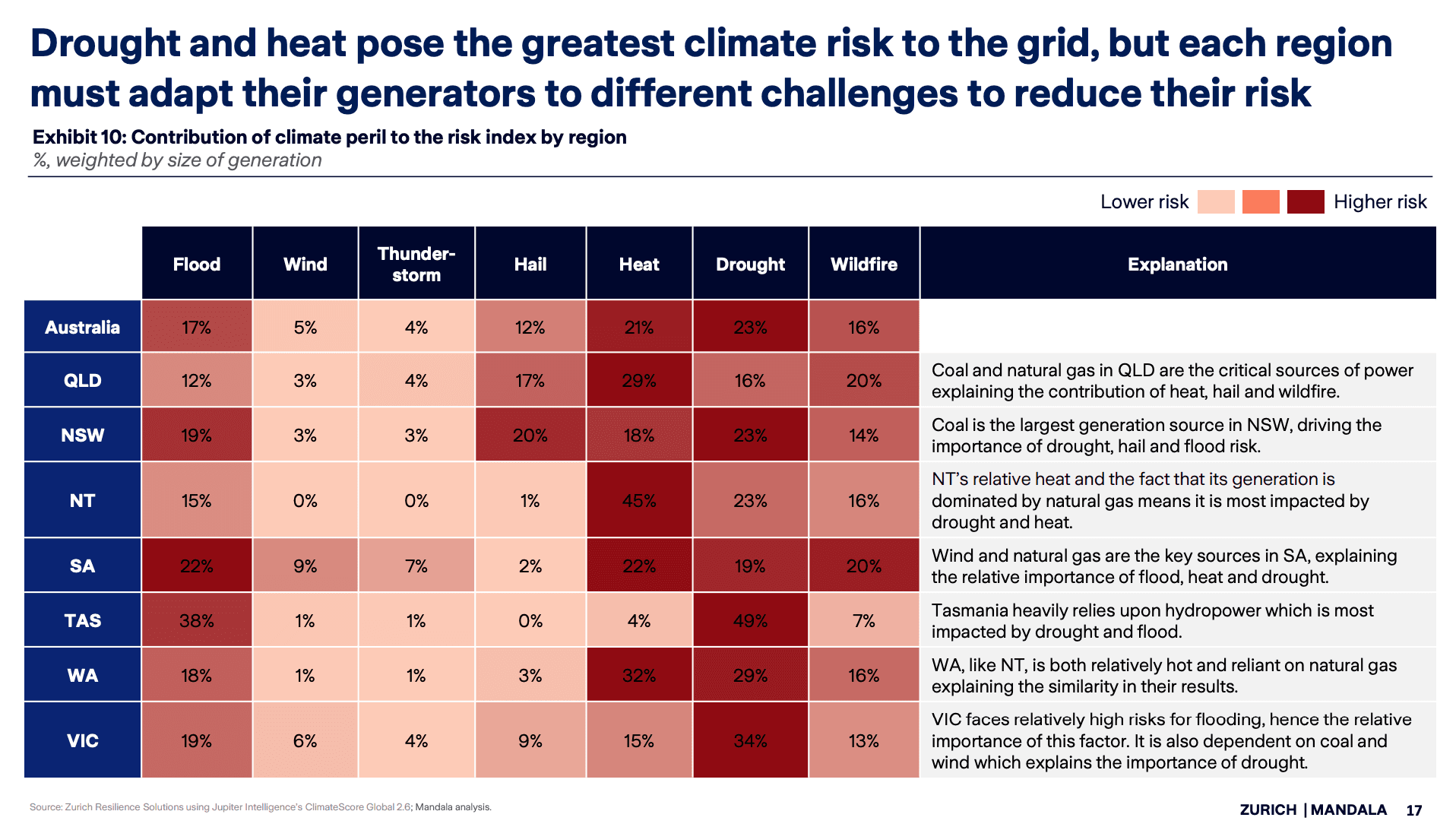

More work must be done to ensure the grid is adapted to the reality of climate change

The impacts of extreme weather events caused by climate change put the stability and efficiency of Australia’s energy industry at risk. Extreme weather can impact all points of the energy production and consumption process – including fuel extraction, processing, transportation, generation, transmission and storage, and customer demand. As shown by this report, site selection and planning is critical to ensure new infrastructure is resilient given variability in peril type and severity is significantly impacted by geography. Beyond this, structural and management adaptation measures are also important for building resilience, particularly for existing sites.

This analysis, conducted in conjunction with Mandala Partners, hopefully represents a useful input into achieving an appropriate and resilient energy transition.

Read our latest posts

Building an AI-Empowered Workforce: Priority Framework

Building on the initial report with FSO into generative AI, ‘Impact of generative AI on skills in the workplace’, we have been examining how the training system should prioritise its response to the impact of this emerging technology on finance, technology and business training products. The report seeks to assist the FSO to prioritise areas for attention when collaborating with training providers and industry to help ensure finance, tech and business VET qualifications reflect the needs of the economy.

18 Jun, 2024

Crown's National Economic Contribution

Mandala's latest report, commissioned by Crown Resorts, highlights the significant contributions of Crown to Australia's economy and society. Annually, Crown injects nearly $5 billion into the economy, including $527 million in taxes that fund essential public services like education, health, and infrastructure. Crown supports local businesses by spending $1 billion with 3,900 suppliers, 83% of which are small and medium enterprises. As the largest hospitality employer in Australia, Crown provides jobs for nearly 30,000 people, fostering a diverse workforce. Crown's resorts attract 36 million visitors annually, bolstering Australia's status as a premier tourism destination. Through Crown College, the company trains the next generation of hospitality professionals, with 10% of Certificate III graduates in key cities. Additionally, Crown has donated $83 million to charities and community initiatives, demonstrating a strong commitment to social responsibility and community support.

14 Jun, 2024

Economic impact of removing radio caps for sound recordings

Mandala's latest report with PPCA explores the economic impact of removing radio caps for sound recordings on Australian artist incomes, the potential investment in Australian artists and music from increased revenue, and the likely impact on radio profit margins from higher royalty rates. We have found that removing the caps could lead to an additional $4.8 million paid to Australian artists in royalties in 2024-25 and artists played on radio could see up to $19,100 in additional income per year, or a 78% increase in income. If caps are removed, increased reinvestment from record labels could see double the number of new local artists played on radio for the first time.

14 Jun, 2024

Earth Fire Alliance: Understanding Wildfires for a Safer Planet

Mandala has partnered with Earth Fire Alliance, the global non-profit coalition committed to delivering transformative real-time data and insights from all wildfires on Earth, to report on the economic impact of wildfires. Wildfires are increasing in frequency and intensity; early detection and prevention can help minimize costs and damages sustainably, and potentially save lives. As extreme wildfires are projected to increase up to 33% by 2050, our research highlights early detection could reduce annual direct fire damage costs by approximately US$1.2 billion across Australia, USA, and Southern Europe alone. The most significant, and harder to quantify savings, will be from data-driven initiatives beyond suppression that discern beneficial fires from potential disasters, helping restore a natural balance with wildfire.

14 Jun, 2024