Australia's opportunities and challenges in Nickel

08.02.2024 - 12:59

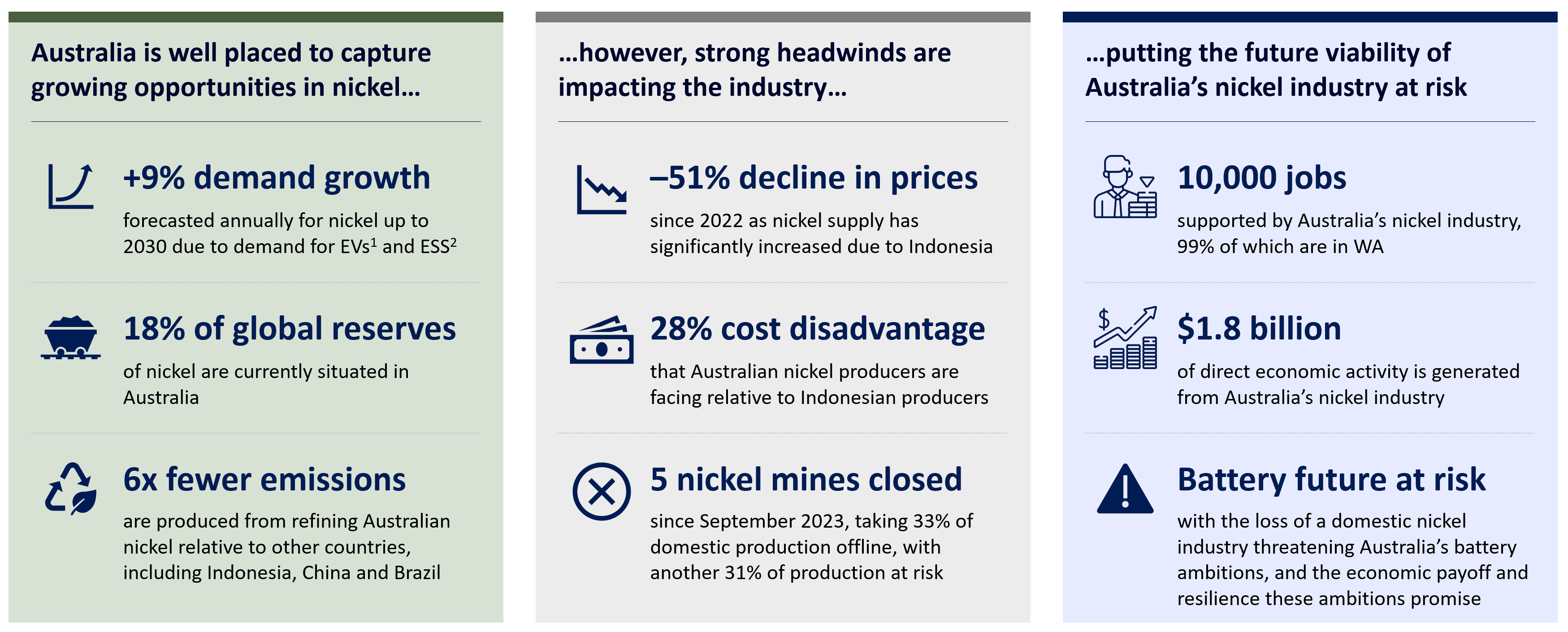

Our new report ‘A Critical Juncture’, commissioned by the Chamber of Minerals and Energy of Western Australia, explores Australia's opportunities and challenges in nickel. Our report finds we have inherent advantages as Australia is well placed to capture growing opportunities in nickel with a 9% annual growth forecast. Australia holds 18% of global reserves, which we can refine with significantly less emissions than our competitors. However, growing supply from cheaper Indonesian nickel producers that are more cost-competitive has led to lower prices, which has already seen the closure of a third of Australia’s nickel production. This puts approximately 10,000 jobs, $1.8 billion of economic activity, and Australia’s future battery industry at risk.

Australian nickel has significant opportunities, however strong headwinds are placing its future viability at risk.

The energy transition offers significant opportunities for Western Australia’s resources industry and minerals exports such as nickel.

As the world accelerates efforts aimed at electrification and moves away from fossil fuels, Western Australia and Australia will need to capture growing opportunities in battery minerals, such as nickel, lithium, and cobalt. Battery demand is expected to increase by 24 per cent annually over the coming decade, driving the need for battery minerals.

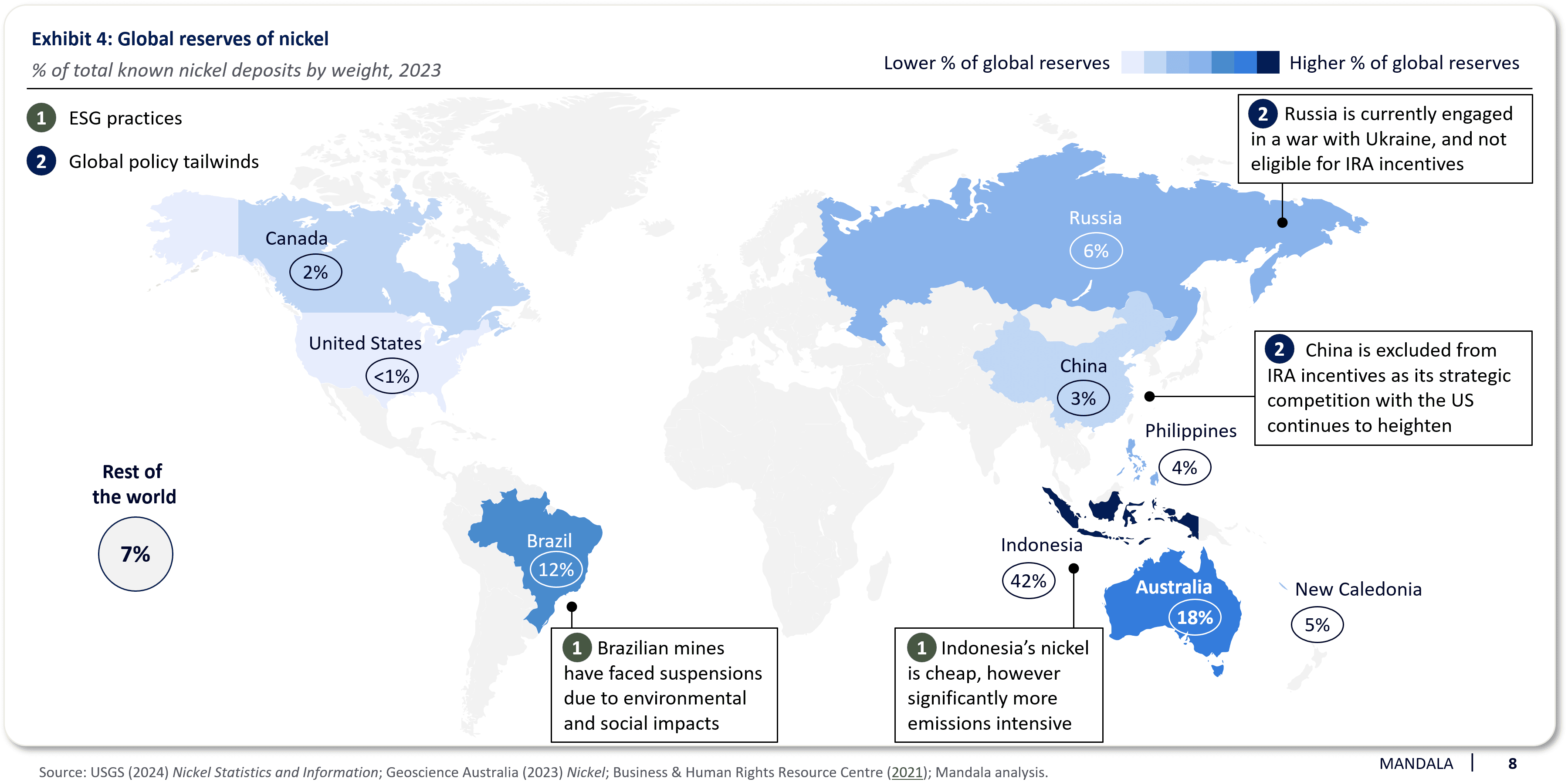

Australia, and Western Australia in particular, is positioned to play an important role in the global battery value chain. Australia holds 18 per cent of global nickel reserves while also having (1) strong ESG practices and (2) global policy tailwinds.

However, the Australian nickel industry is facing strong headwinds, and its future viability is at risk.

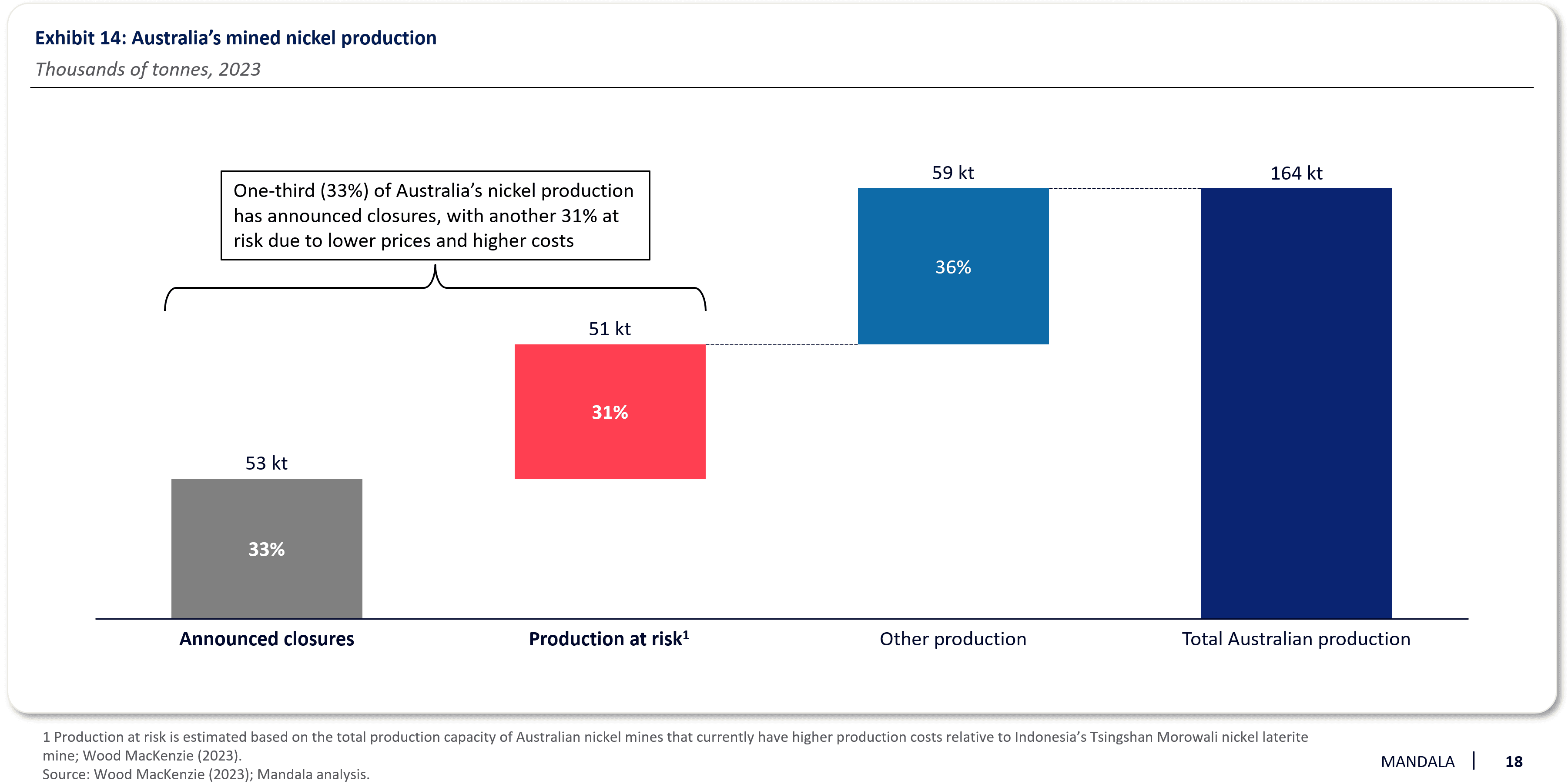

Recent drops in nickel price (down 51 per cent since 2022) and growing cost pressures in Australia have led to five Western Australian nickel producers, constituting a third of annual domestic production, announcing closures, with many other producers at risk.

The nickel industry is strategically vital in supporting Australia’s sovereign capability, economic resilience, and resource security. The decline of the nickel industry puts at risk nearly 10,000 jobs, $1.8 billion of economic activity, and Australia’s future battery industry.

Download the full report here.

Read our latest posts

The Fragmentation Tax

Australian retailers operate across a patchwork of inconsistent state and territory regulations that, left unchecked, will cost the economy $26 billion and households $9.4 billion over the next decade. Commissioned by the Australian Retail Council, this Mandala report finds that regulatory fragmentation in retail - Australia's second-largest employer, generating $649 billion in economic activity annually - is compounding the country's productivity crisis at the worst possible time. The report identifies specific issues in transport and logistics, and packaging and waste as priority areas for reform, where harmonisation alone would inject up to $1.65 billion into the economy over 10 years. It recommends the Federal Government use its National Competition Policy framework to drive reform - including a $260 million increase to the National Productivity Fund, a new National Harmonisation Council, and a mandate that Regulatory Impact Statements explicitly quantify fragmentation risks.

23 Feb, 2026

Reforming Victoria's Windfall Gains Tax

Victoria's Windfall Gains Tax (WGT), introduced in July 2023, has compounded a decade of new and increased property taxes that have made Melbourne the most costly major city in Australia for development. Commissioned by the Property Council Victoria, this Mandala report finds that developer taxes and charges now account for 18% of total costs on Melbourne developments - double the rate of Sydney - and that the average WGT liability pushes project returns below the viability threshold. The analysis estimates that removing the WGT could unlock $1.4 billion in additional annual investment, support 2,700 jobs and deliver the equivalent of 3,100 new homes per year by 2030. The report also presents a suite of targeted reforms across financial relief, predictability, and policy alignment that would restore investor confidence while balancing the government's revenue objectives.

23 Feb, 2026

Restoring affordable access to specialist care in Australia

In this report, Mandala and Private Healthcare Australia (PHA) studied the affordability of specialist care in Australia. We find that specialist fees are rising, exacerbating cost-of-living pressures on consumers and worsening the affordability of healthcare. We propose a targeted package of measures to improve consumers' ability to access high-quality care, of their choosing, at fair and transparent costs.

3 Feb, 2026

Critical Minerals Strategic Reserve Design

Mandala's latest report for the Association of Mining and Exploration Companies (AMEC) sets out an industry-informed approach to implementing Australia’s Critical Minerals Strategic Reserve, with a focus on rare earths critical to national security and the energy transition. Bringing together 10 Australian rare earth developers, and drawing on international precedents and economic analysis, the report recommends a commercially viable and fiscally sustainable model to support new investment in Australia’s rare earths sector while managing risk to taxpayers.

12 Jan, 2026