Climate Risk Index for the Australian energy sector

20.02.2024 - 03:14

Mandala Partners (Mandala) in conjunction with Zurich Financial Services Australia (Zurich) has produced Australia’s first Climate Risk Index for the national energy generation sector. This report highlights the growing risk of climate change to the grid, how that risk is spread across the grid, and high-level options for mitigating those risks. More than 25% of Australia’s power generation assets are in the three highest categories for climate change risk.

"Australia’s energy generation assets underpin almost every aspect of economic and social interaction in the 21st century, however, much of the focus to date has centered on the risk of the energy grid to climate change, rather than on the risk of climate change to the grid."

- Justin Delaney, Chief Executive Officer, Zurich Australia & New Zealand

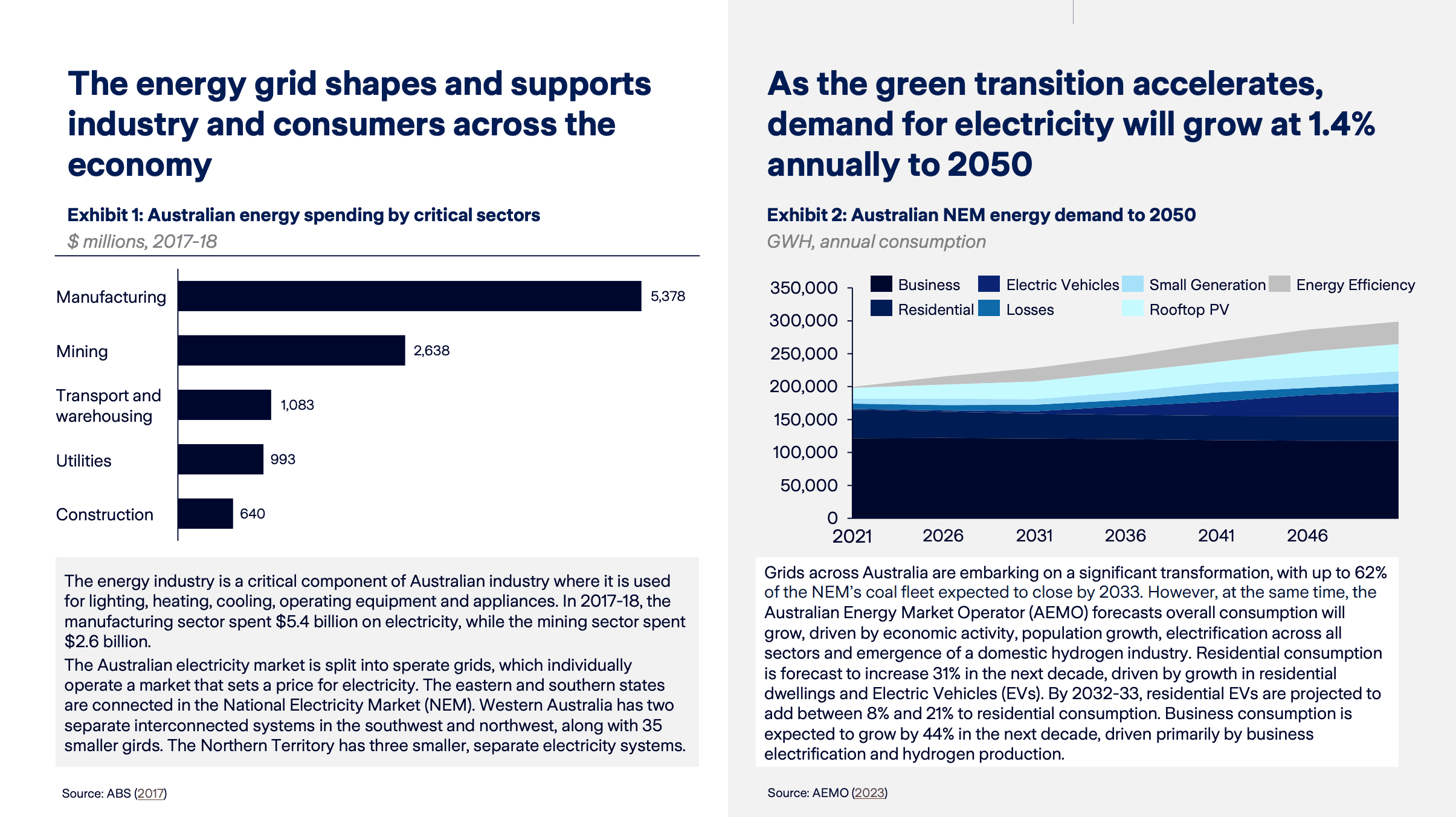

The Australian energy grid is critical to industry, consumers and the green transition

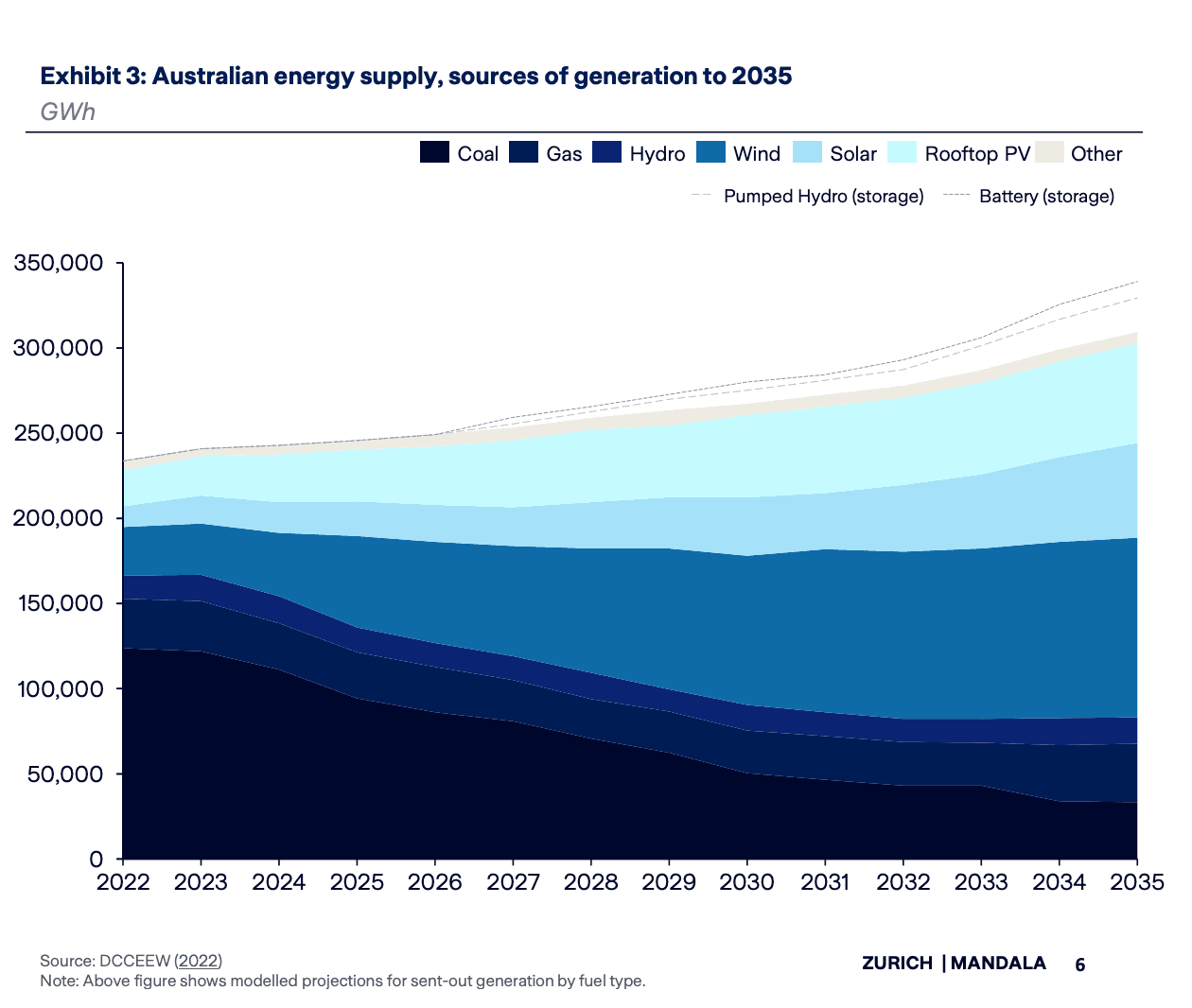

The last decade of energy policy has focused on transitioning to renewable energy sources and reducing prices for consumers. While prices have steadily climbed during this period, policies to transition the Australian grid have been fruitful.

During this period, the capacity of electricity generation from renewable sources has increased 215% from 26,700 GWh of generation in 2011-12 to 84,000 GWh in 2021-22. Under the Renewable Energy Target, this transition is required to accelerate with the goal to boost renewables to 82% of the grid by 2030.

This transition has been supported by the Australian Government’s green bank, the Clean Energy Finance Corporation (CEFC), which has invested more than $12.7 billion in large-scale renewable and transmission-related projects during the last 10 years.

The Australian Government’s October 2022-23 budget included $20 billion for its ‘Rewire the Nation’ program, a National Reconstruction Fund of $15 billion and the Powering the Regions Fund of $1.9 billion. Likewise, state governments have made numerous significant investments in energy infrastructure including renewable projects, transmission upgrades, storage capabilities and jobs plans.

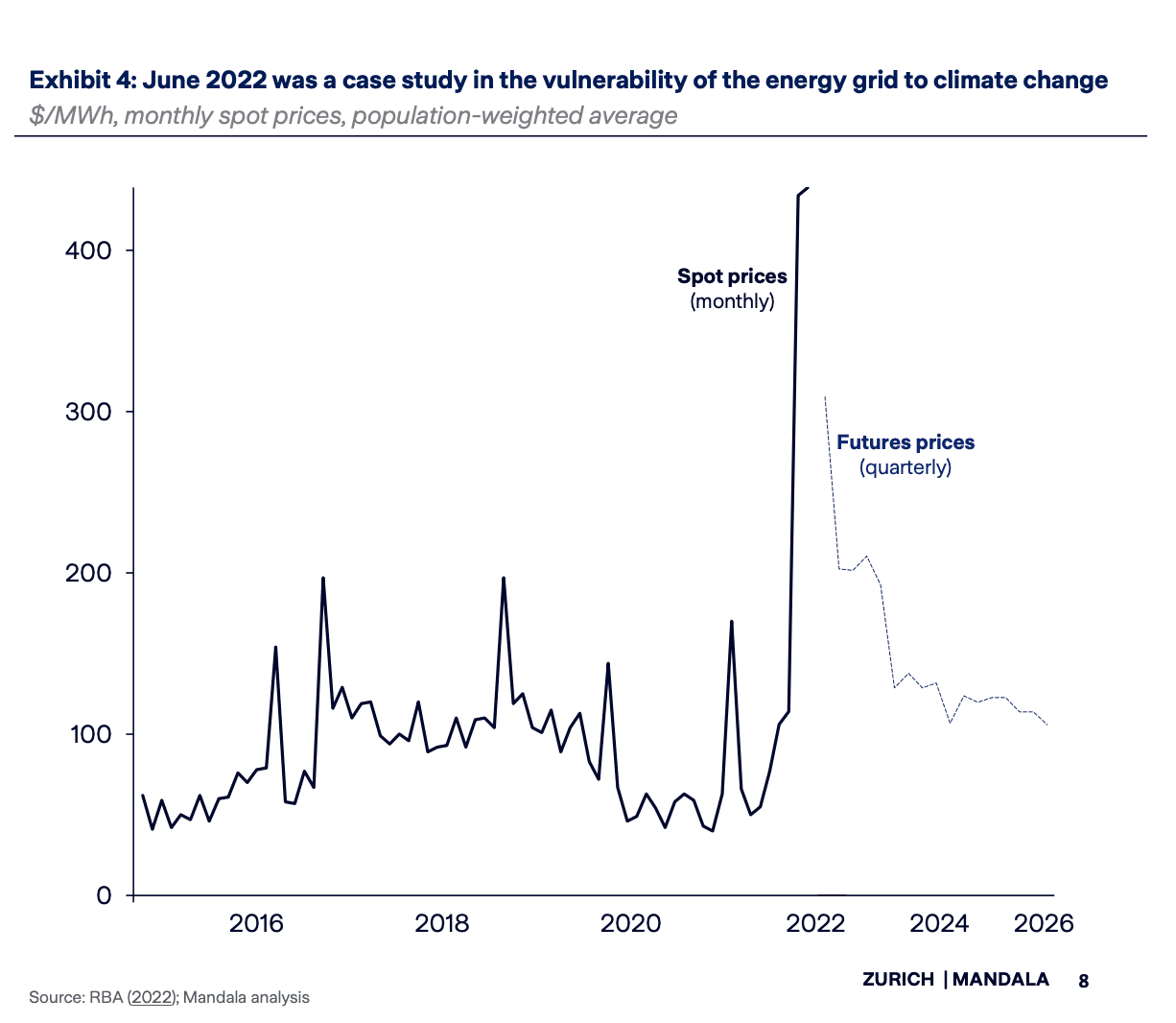

Climate affects the stability and efficiency of the grid, leaving Australia vulnerable to growing climate risk

In June 2022, the monthly average spot price for electricity hit above $350/MWh. In response, the Australian Energy Market Operator (AEMO) suspended the entire National Electricity Market (NEM), declaring the spot market had become “impossible to operate”.

June 2022 was a case study in the vulnerability of the energy grid, showing how a system already disrupted by global factors can be tipped into chaos due to climate-related factors.

Driven by Russia’s invasion of Ukraine, demand and prices for thermal coal sharply increased. Other coal generators faced further disruption due to staff shortages and the impacts of La Niña on coal production. Lower-than expected power generation from renewables also contributed to the overall price increase as adverse weather reduced the efficiency of solar generation. Meanwhile, total demand from the NEM was higher than in previous years. Exceptional rainfall and a series of cold fronts had impacted Queensland and Victoria and led to relatively high total demand from the period.

As these factors drove up prices, the AEMO implemented a price cap for a few days. This led to generators withdrawing from the market and caused the AEMO to suspend the NEM.

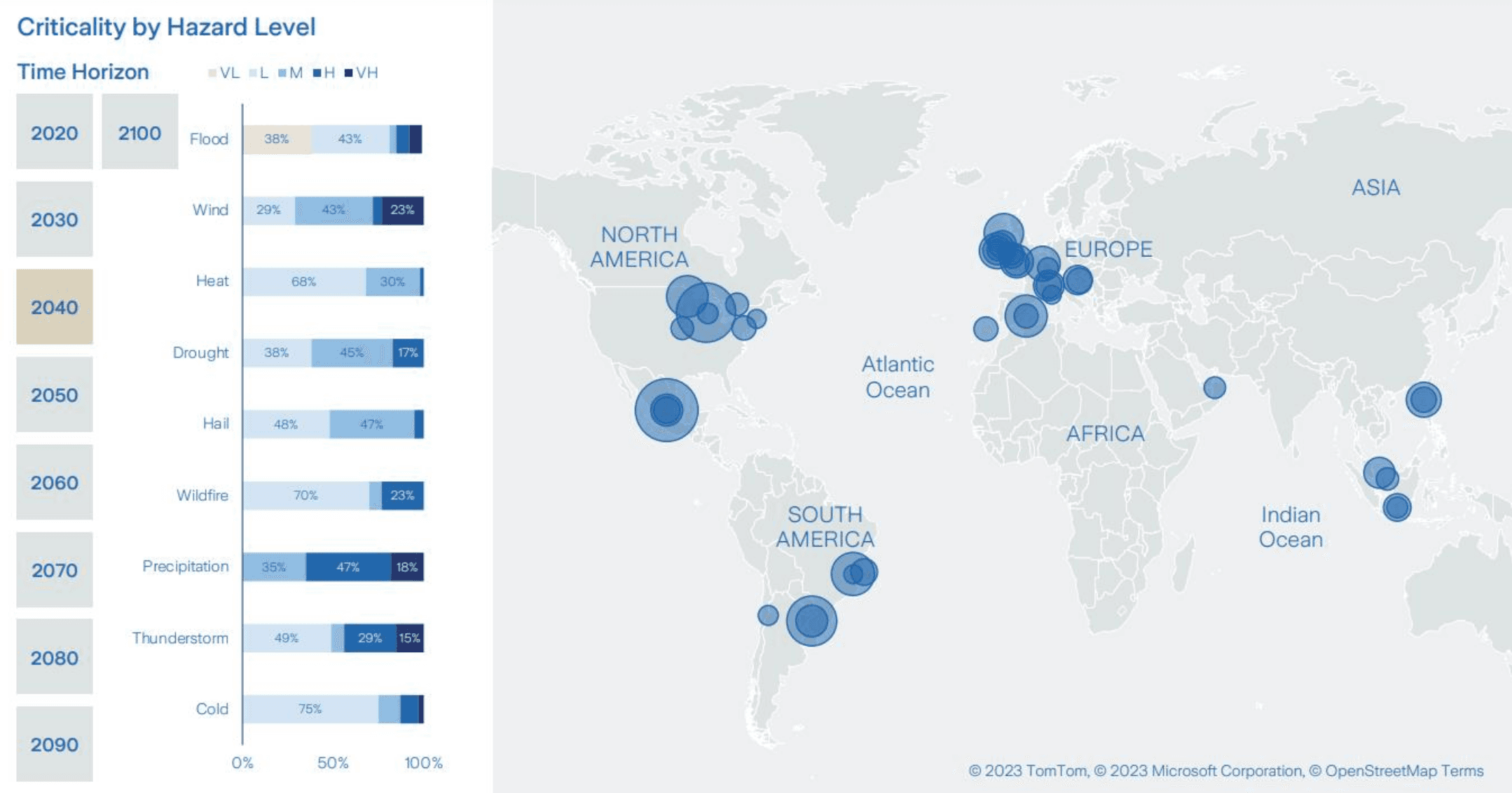

Zurich Resilience Solutions (ZRS) provides insights and solutions to help organisations proactively manage and build resilience to traditional and evolving risks, such as climate change and cyber

ZRS global exposure analysis transforms location or asset data into deep climate risk insights. Through a customised and interactive dashboard, businesses and asset owners can understand the probability that climate risks – such as heat, flood and fire – may impact a specific asset or portfolio of locations over different time horizons using three IPCC-based climate scenarios. These insights quantify and contextualise climate exposure to ensure risk can be understood, tracked and shared in order to appropriately prioritise actions and investments.

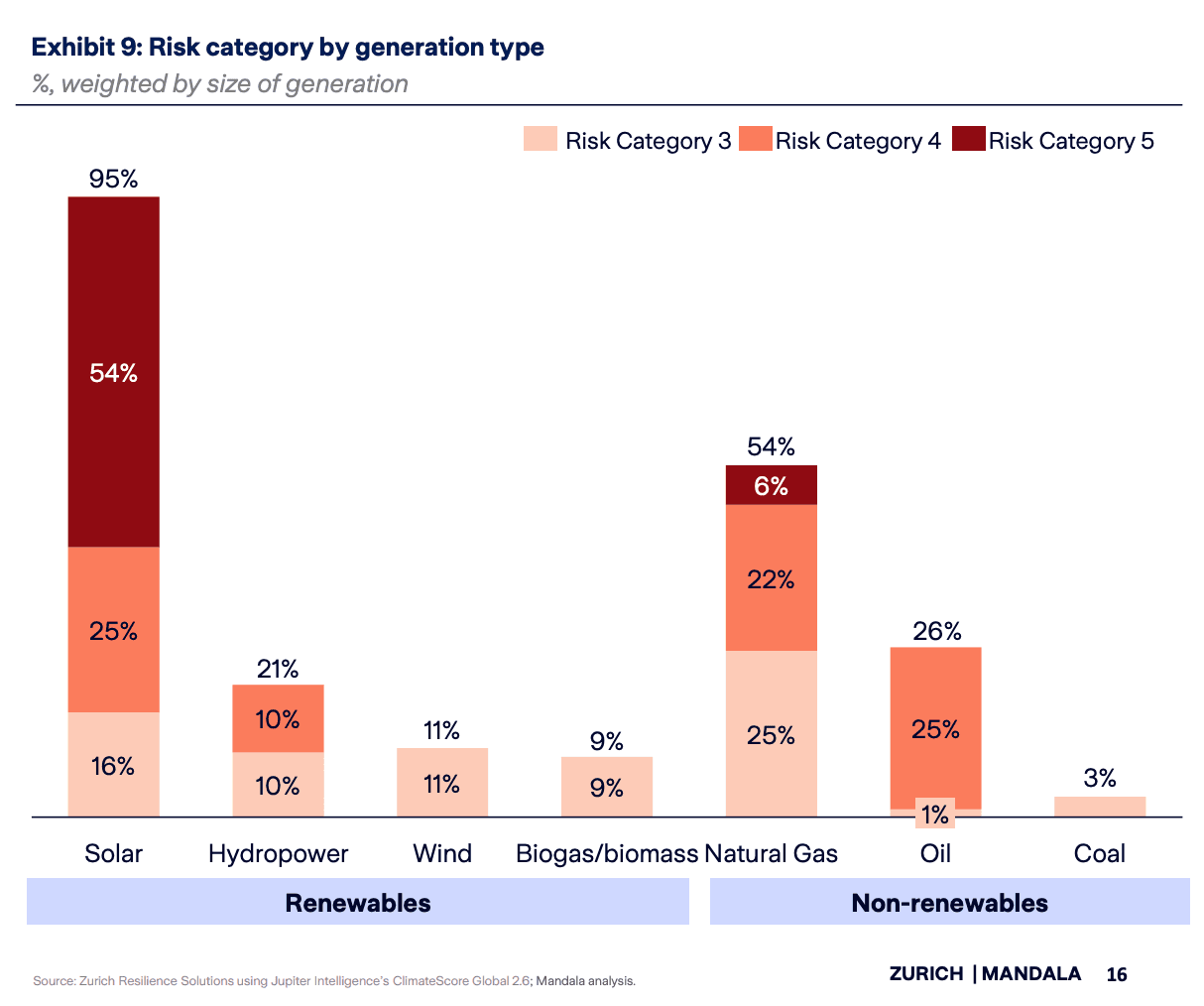

Solar generation is currently most consistently at risk, while coal and biomass are least at risk across Australia

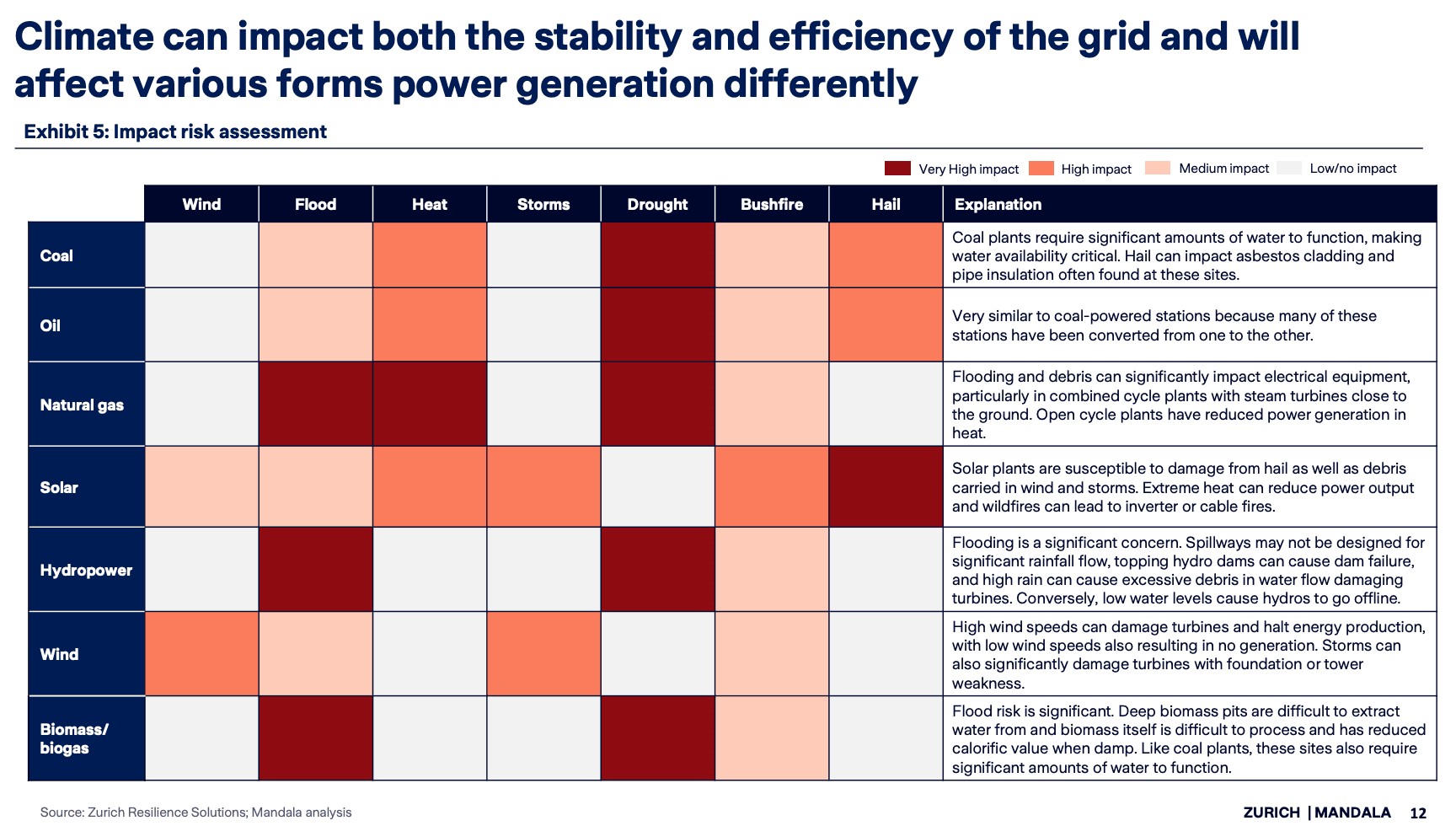

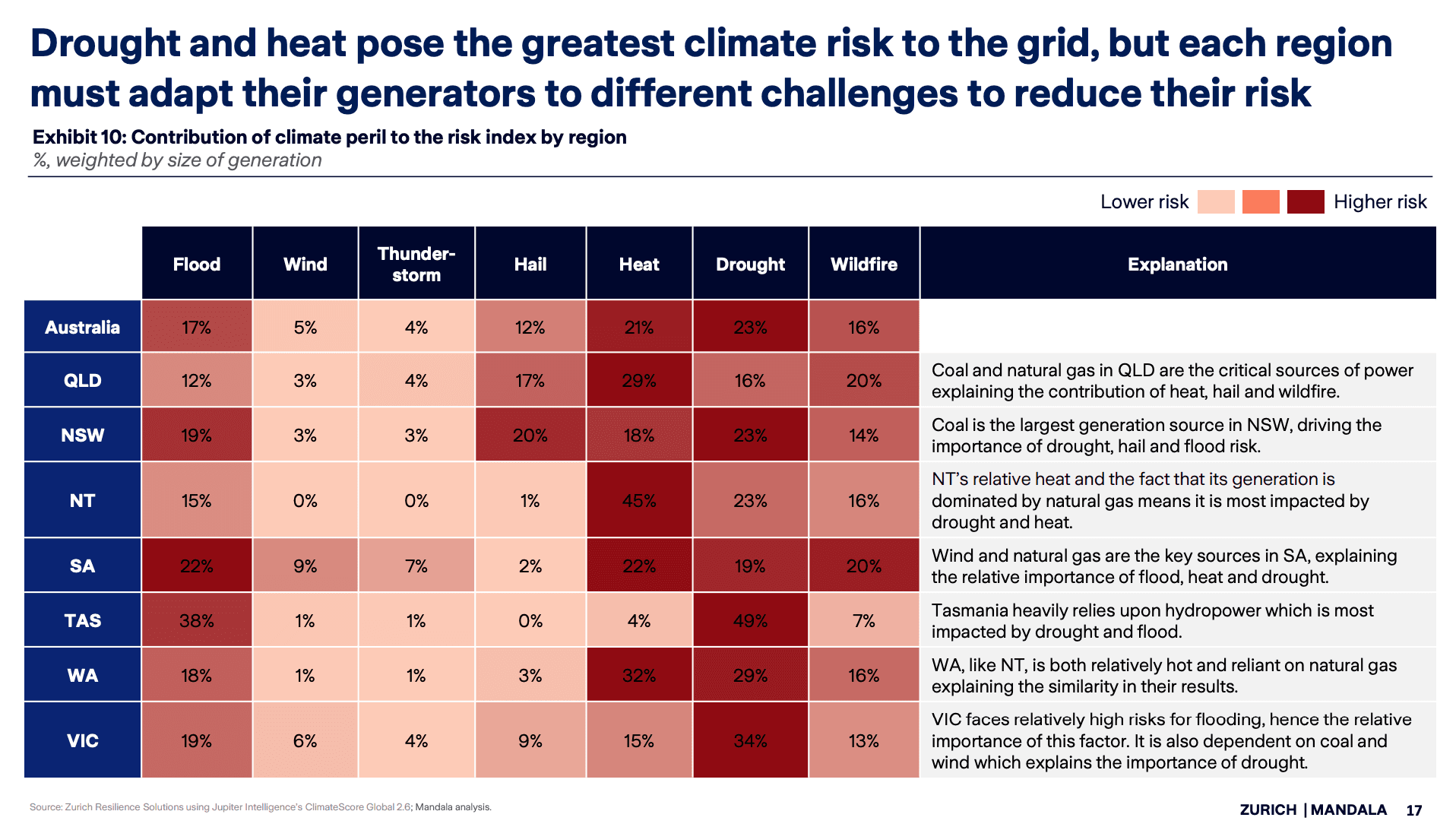

The risk posed by climate perils varies significantly by generation type. Based on the location of current generation sites, solar and natural gas face the highest risk.

The Zurich-Mandala Index found that 95% of solar generation sites were in the three highest risk categories, with 54% in the highest category. This reflects the relative vulnerability of solar panels to numerous perils. Note that this analysis does not include rooftop solar as no granular data is available on its locations. This means that overall risk for solar generation may be more diversified.

The second most at-risk generation types were natural gas and oil, which were found to have 54% and 26% of their generation respectively in risk category 3 and above. This result has been driven by the susceptibility of these generation types to perils such as high temperatures and drought.

Other forms of renewable energy like wind and biogas/biomass sat alongside coal with relatively low risk. A minimal number of these sites were in the highest three categories and less than 1% of generation were in risk categories 4 and 5.

More work must be done to ensure the grid is adapted to the reality of climate change

The impacts of extreme weather events caused by climate change put the stability and efficiency of Australia’s energy industry at risk. Extreme weather can impact all points of the energy production and consumption process – including fuel extraction, processing, transportation, generation, transmission and storage, and customer demand. As shown by this report, site selection and planning is critical to ensure new infrastructure is resilient given variability in peril type and severity is significantly impacted by geography. Beyond this, structural and management adaptation measures are also important for building resilience, particularly for existing sites.

This analysis, conducted in conjunction with Mandala Partners, hopefully represents a useful input into achieving an appropriate and resilient energy transition.

Read our latest posts

The Fragmentation Tax

Australian retailers operate across a patchwork of inconsistent state and territory regulations that, left unchecked, will cost the economy $26 billion and households $9.4 billion over the next decade. Commissioned by the Australian Retail Council, this Mandala report finds that regulatory fragmentation in retail - Australia's second-largest employer, generating $649 billion in economic activity annually - is compounding the country's productivity crisis at the worst possible time. The report identifies specific issues in transport and logistics, and packaging and waste as priority areas for reform, where harmonisation alone would inject up to $1.65 billion into the economy over 10 years. It recommends the Federal Government use its National Competition Policy framework to drive reform - including a $260 million increase to the National Productivity Fund, a new National Harmonisation Council, and a mandate that Regulatory Impact Statements explicitly quantify fragmentation risks.

23 Feb, 2026

Reforming Victoria's Windfall Gains Tax

Victoria's Windfall Gains Tax (WGT), introduced in July 2023, has compounded a decade of new and increased property taxes that have made Melbourne the most costly major city in Australia for development. Commissioned by the Property Council Victoria, this Mandala report finds that developer taxes and charges now account for 18% of total costs on Melbourne developments - double the rate of Sydney - and that the average WGT liability pushes project returns below the viability threshold. The analysis estimates that removing the WGT could unlock $1.4 billion in additional annual investment, support 2,700 jobs and deliver the equivalent of 3,100 new homes per year by 2030. The report also presents a suite of targeted reforms across financial relief, predictability, and policy alignment that would restore investor confidence while balancing the government's revenue objectives.

23 Feb, 2026

Restoring affordable access to specialist care in Australia

In this report, Mandala and Private Healthcare Australia (PHA) studied the affordability of specialist care in Australia. We find that specialist fees are rising, exacerbating cost-of-living pressures on consumers and worsening the affordability of healthcare. We propose a targeted package of measures to improve consumers' ability to access high-quality care, of their choosing, at fair and transparent costs.

3 Feb, 2026

Critical Minerals Strategic Reserve Design

Mandala's latest report for the Association of Mining and Exploration Companies (AMEC) sets out an industry-informed approach to implementing Australia’s Critical Minerals Strategic Reserve, with a focus on rare earths critical to national security and the energy transition. Bringing together 10 Australian rare earth developers, and drawing on international precedents and economic analysis, the report recommends a commercially viable and fiscally sustainable model to support new investment in Australia’s rare earths sector while managing risk to taxpayers.

12 Jan, 2026