Surf, Shop, Save

28.02.2024 - 01:12

Our new report ‘Surf, Shop, Save’, commissioned by Amazon, explores how online channels have helped to lower the cost of living in Australia. Our report finds that online channels have helped reduce the cost of living pressures for Australians through cost-efficiency and competition effects. Since 2019, prices for online channels have been deflationary, while CPI has grown. When compared to each other, CPI has grown 10.5 percentage points more than prices for online channels for comparable categories of goods. During this time, online channels have also placed downward pressure on prices quoted by offline channels, helping reduce inflation by 0.7 percentage points during its peak in 2022. These effects saved Australian households nearly $3,500 on average since 2019.

Online channels help reduce cost of living pressures for Australians through cost-efficiency and competition effects

The retail sector consists of online and offline channels, with retailers using a mix of both to reach consumers, often within a single purchase journey.

Within this omnichannel retail sector, the cost-efficiency effect of online channels sees the cost savings from reduced handling and improved distribution being passed-on to consumers in the form of competitive prices. The competition effect of online channels sees reduced prices across the broader retail sector due to increased competition and increased consumer choice. This allows consumers to shop around for the best price.

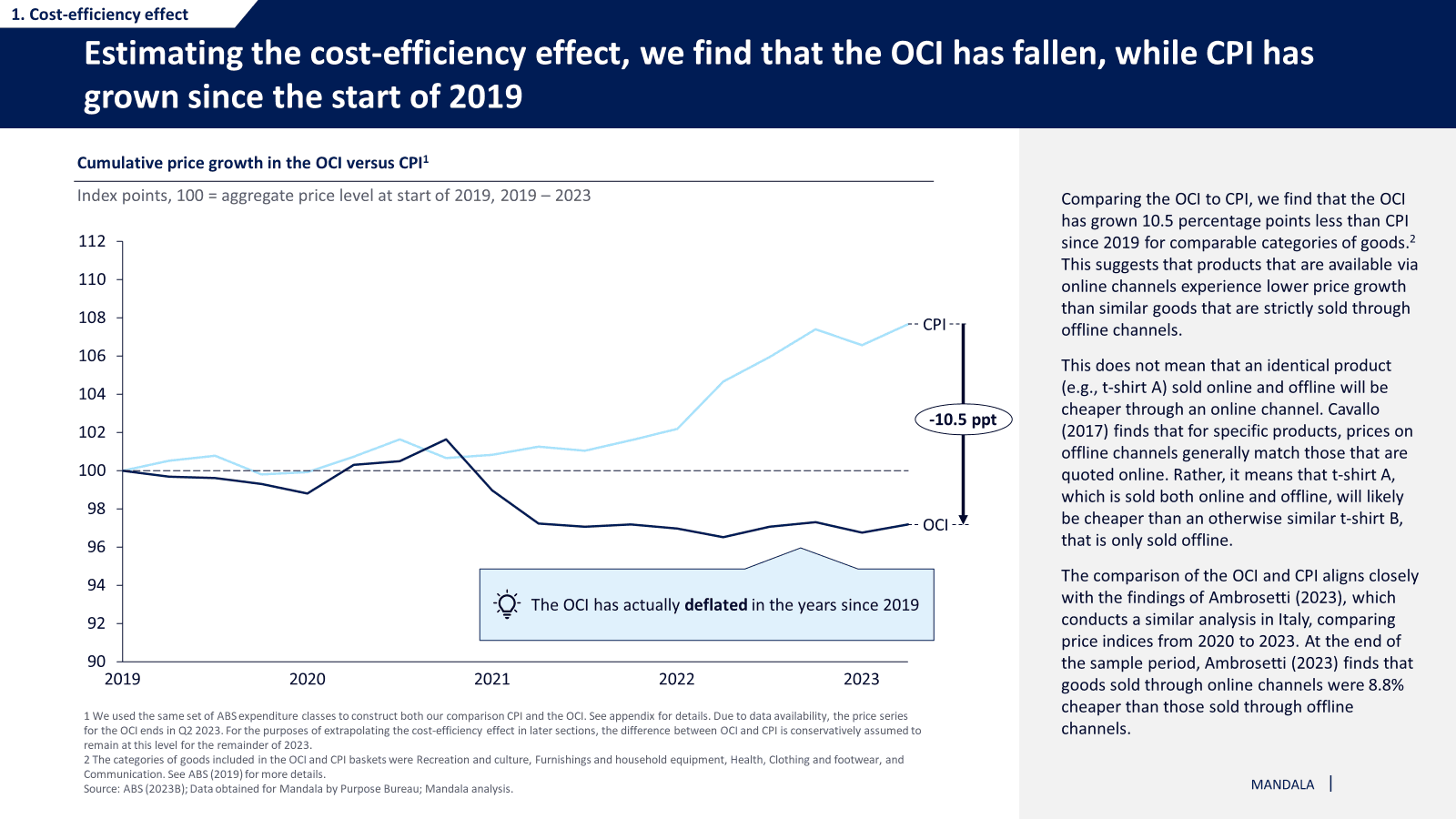

Since 2019, prices for online channels have been deflationary, while CPI has grown

To estimate the cost-efficiency effect, we analysed a sample of over 60,000 distinct products from online channels, creating a time series of prices from 2019 to 2023. Using this data, we constructed an ‘Online Channels Index’ (OCI) and compared each category of the OCI (e.g., clothing and footwear) to the corresponding sub-group of the ABS’ Consumer Price Index (CPI).

Comparing the OCI to CPI, we find that the OCI has grown 10.5 percentage points less than CPI since 2019 for comparable categories of goods. This indicates that products that are available via online channels experience lower price growth than similar goods that are strictly sold through offline channels.

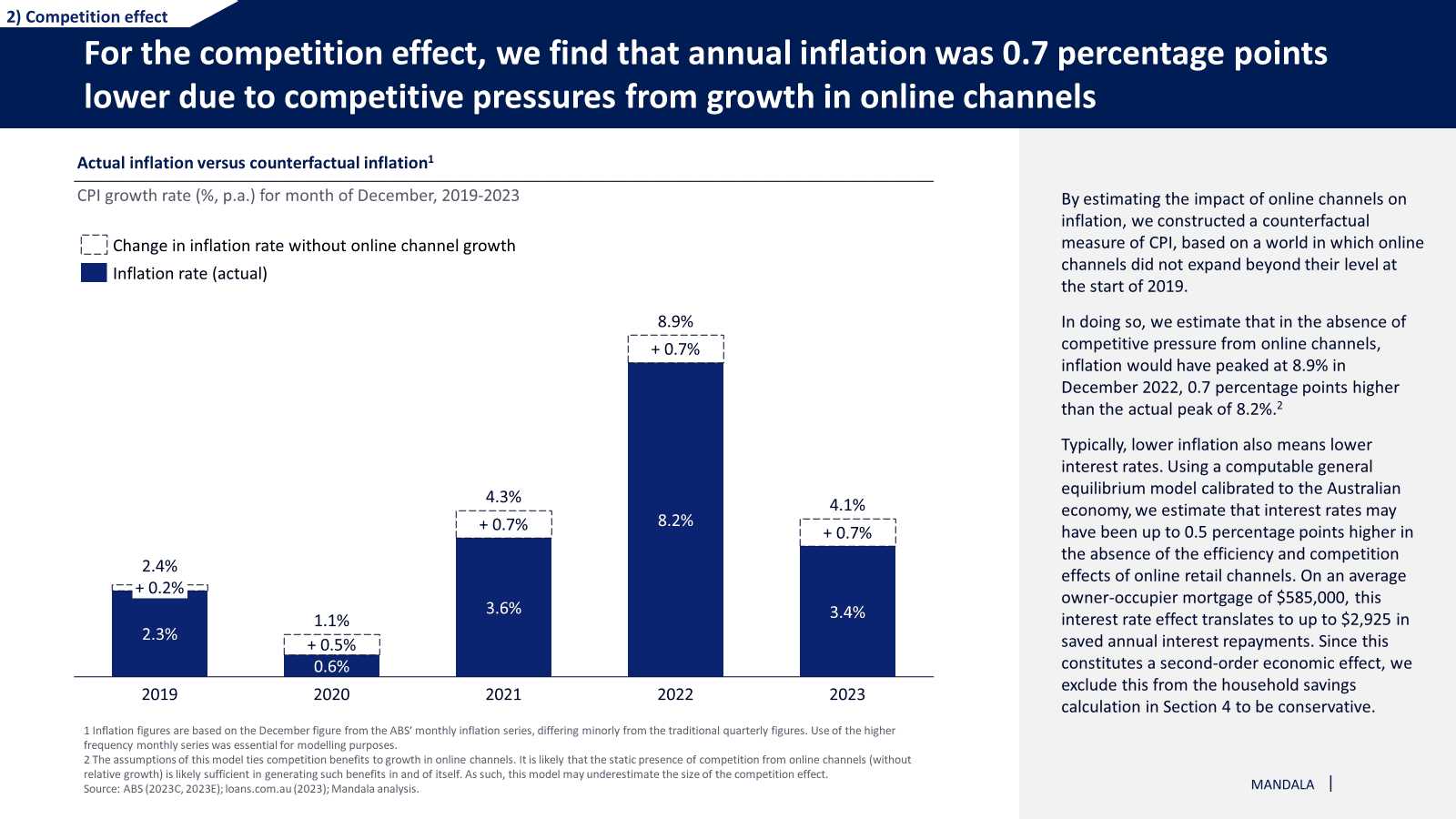

Annual inflation in Australia was 0.7 percentage points lower than it would otherwise have been thanks to the competition effect of online channels

Online retail channels have also placed downward pressure on prices quoted by offline channels. Without online channels, inflation in Australia would have been 0.7 percentage points higher during its peak in 2022.

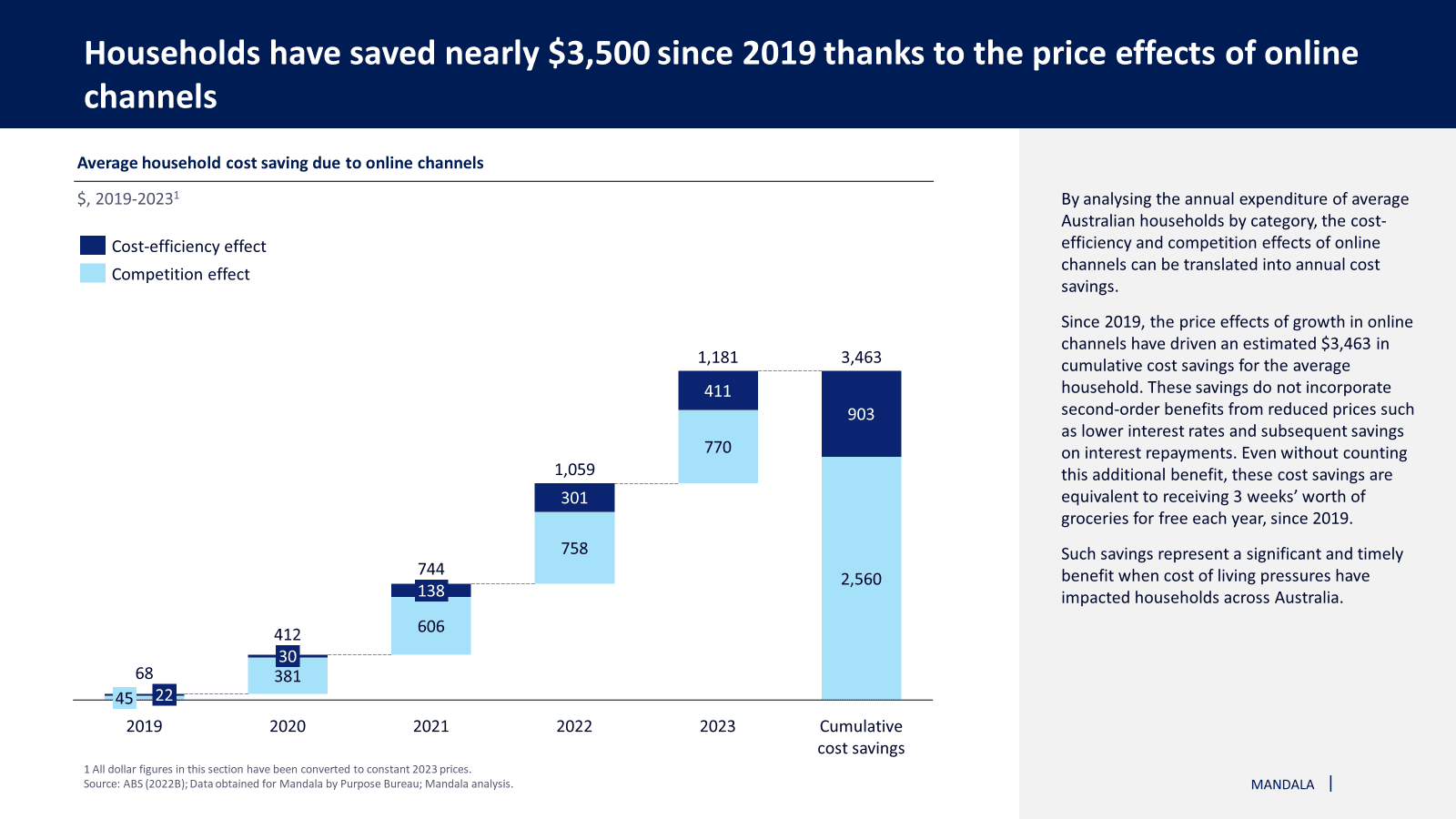

Households have saved nearly $3,500 on average since 2019 thanks to online channels

Since 2019, Australian households have saved almost $3,500 on average due to online channels. Just over a quarter of this (26 per cent) was due to the cost-efficiency effect of online channels, and the remaining 74 per cent was due to the competition effect. The largest cost saving was from expenditure on recreation and culture.

Read the full report here.

Read our latest posts

Restoring affordable access to specialist care in Australia

In this report, Mandala and Private Healthcare Australia (PHA) studied the affordability of specialist care in Australia. We find that specialist fees are rising, exacerbating cost-of-living pressures on consumers and worsening the affordability of healthcare. We propose a targeted package of measures to improve consumers' ability to access high-quality care, of their choosing, at fair and transparent costs.

3 Feb, 2026

Critical Minerals Strategic Reserve Design

Mandala's latest report for the Association of Mining and Exploration Companies (AMEC) sets out an industry-informed approach to implementing Australia’s Critical Minerals Strategic Reserve, with a focus on rare earths critical to national security and the energy transition. Bringing together 10 Australian rare earth developers, and drawing on international precedents and economic analysis, the report recommends a commercially viable and fiscally sustainable model to support new investment in Australia’s rare earths sector while managing risk to taxpayers.

12 Jan, 2026

The Value of Online Payments to New Zealand Businesses

Mandala partnered with Stripe on a research report based on the findings of a survey of 200 New Zealand businesses around the value of online payments and opportunities for future innovation.

18 Dec, 2025

Optimising Australia’s Specialist Investment Vehicles for the Net Zero Journey

Mandala, in partnership with IGCC, explores how Australia’s Specialist Investment Vehicles (SIVs) are deploying public capital to accelerate the net zero transition. The report examines the current funding landscape, identifies structural challenges that limit the effectiveness of public investment, and sets out a pathway to evolve the SIV system into a more coordinated, capital-led model aligned with national priorities.

10 Dec, 2025