Australia’s Quantum Moment

30.04.2024 - 06:34

With a $940 million investment in PsiQuantum announced, our launch research supports the economic case for building the world’s first fault-tolerant quantum computer in Brisbane, Australia. Our research found this hybrid investment bet will directly support 2,800 high-skilled jobs across the Queensland and the Australian economies and support $5.1 billion of additional economic activity.

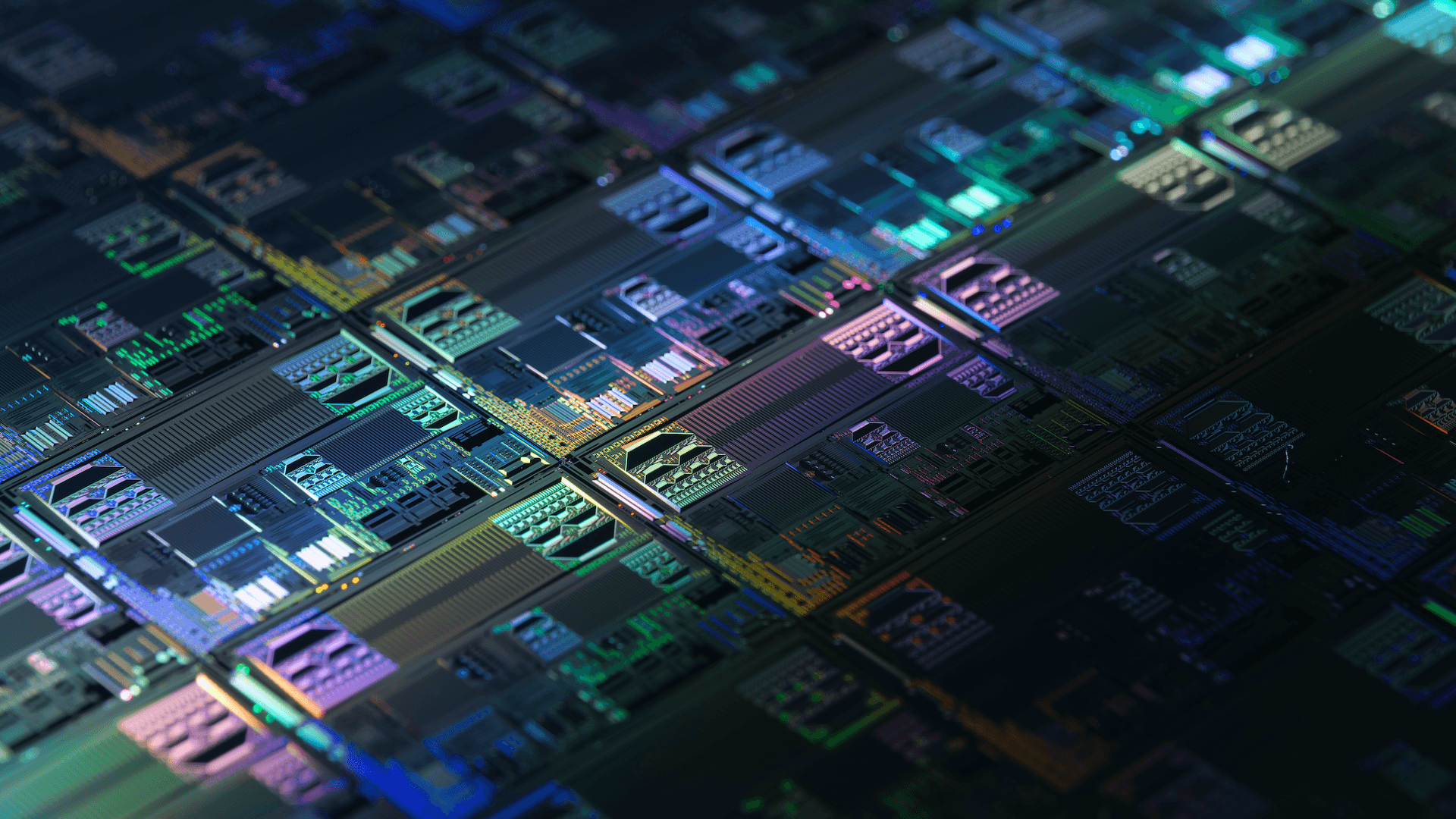

Cover image: PsiQuantum 2024

Australia needs a sophisticated “hybrid approach” to economic policymaking if we are to address 21st century challenges

Market liberalisation in the 1980s and 90s enabled Australia to develop a highly productive, highly competitive economy that saw major increases in Australian living standards.

But there has been a two-decade drought in major productivity-boosting economic reform. Global socioeconomic trends such as decarbonisation, digitisation, trade de-risking, and ageing populations mean that the pathway to future prosperity is uncertain. Today, productivity growth and income growth are stagnant.

21st century policy challenges increasingly require ’hybrid solutions’: sophisticated combinations of government and market tools that promote equity and efficiency. Governments around the world are making large public investments to grow high-tech, high-value sectors that have positive externalities across industries and the economy. There is a case for investments in platforms and infrastructure that creates and extends a comparative advantage for Australia.

Quantum computing represents a unique and transformative opportunity for Australia, but substantial investments will be needed to realise its potential

The Government has identified critical sectors for support that can be strategically beneficial for Australia. These are sectors that have strong positive spillovers for other industries, the community and the economy and which the private sector will struggle to deliver, thus warranting government support.

This report outlines the benefits and advantages of Australia in converting a strong research base in quantum computing to a fully commercialised, world-leading industry. There are considerable opportunities to spur firms, innovations and capabilities by investing in underlying infrastructure. It is a clear area where a hybrid government-private approach will deliver substantial spillover benefits across the economy and community by building a new capability.

Close engagement across Australian governments is crucial for success, especially given the spillover benefits on offer, and the geostrategic and security implications at stake.

A utility-scale quantum computer built in Australia in the next decade will unlock transformational opportunities and advantages

A utility-scale, fault-tolerant quantum computer (FTQC) will generate substantial benefits for Australians over the coming decades. Public investment is crucial to realising the public good

on offer.

These include economic benefits from a new technology; ecosystem benefits for the local quantum industry; research and innovation benefits across the economy; and geostrategic benefits.

The construction of a utility-scale FTQC could create 2,800 jobs for the local economy and $5.1B in economic benefits.

A fully-functioning, utility-scale FTQC could benefit sectors as diverse as health, security, climate, agriculture, finance, transport, and energy. It would establish Australia as a world-leader in a critical geostrategic technology, bringing benefits to the region and establishing new sovereign capabilities for Australia.

Download the full report here.

Visit the PsiQuantum website here.

Read our latest posts

The Fragmentation Tax

Australian retailers operate across a patchwork of inconsistent state and territory regulations that, left unchecked, will cost the economy $26 billion and households $9.4 billion over the next decade. Commissioned by the Australian Retail Council, this Mandala report finds that regulatory fragmentation in retail - Australia's second-largest employer, generating $649 billion in economic activity annually - is compounding the country's productivity crisis at the worst possible time. The report identifies specific issues in transport and logistics, and packaging and waste as priority areas for reform, where harmonisation alone would inject up to $1.65 billion into the economy over 10 years. It recommends the Federal Government use its National Competition Policy framework to drive reform - including a $260 million increase to the National Productivity Fund, a new National Harmonisation Council, and a mandate that Regulatory Impact Statements explicitly quantify fragmentation risks.

23 Feb, 2026

Reforming Victoria's Windfall Gains Tax

Victoria's Windfall Gains Tax (WGT), introduced in July 2023, has compounded a decade of new and increased property taxes that have made Melbourne the most costly major city in Australia for development. Commissioned by the Property Council Victoria, this Mandala report finds that developer taxes and charges now account for 18% of total costs on Melbourne developments - double the rate of Sydney - and that the average WGT liability pushes project returns below the viability threshold. The analysis estimates that removing the WGT could unlock $1.4 billion in additional annual investment, support 2,700 jobs and deliver the equivalent of 3,100 new homes per year by 2030. The report also presents a suite of targeted reforms across financial relief, predictability, and policy alignment that would restore investor confidence while balancing the government's revenue objectives.

23 Feb, 2026

Restoring affordable access to specialist care in Australia

In this report, Mandala and Private Healthcare Australia (PHA) studied the affordability of specialist care in Australia. We find that specialist fees are rising, exacerbating cost-of-living pressures on consumers and worsening the affordability of healthcare. We propose a targeted package of measures to improve consumers' ability to access high-quality care, of their choosing, at fair and transparent costs.

3 Feb, 2026

Critical Minerals Strategic Reserve Design

Mandala's latest report for the Association of Mining and Exploration Companies (AMEC) sets out an industry-informed approach to implementing Australia’s Critical Minerals Strategic Reserve, with a focus on rare earths critical to national security and the energy transition. Bringing together 10 Australian rare earth developers, and drawing on international precedents and economic analysis, the report recommends a commercially viable and fiscally sustainable model to support new investment in Australia’s rare earths sector while managing risk to taxpayers.

12 Jan, 2026