Spirits industry sector competitiveness plan

10.04.2024 - 02:28

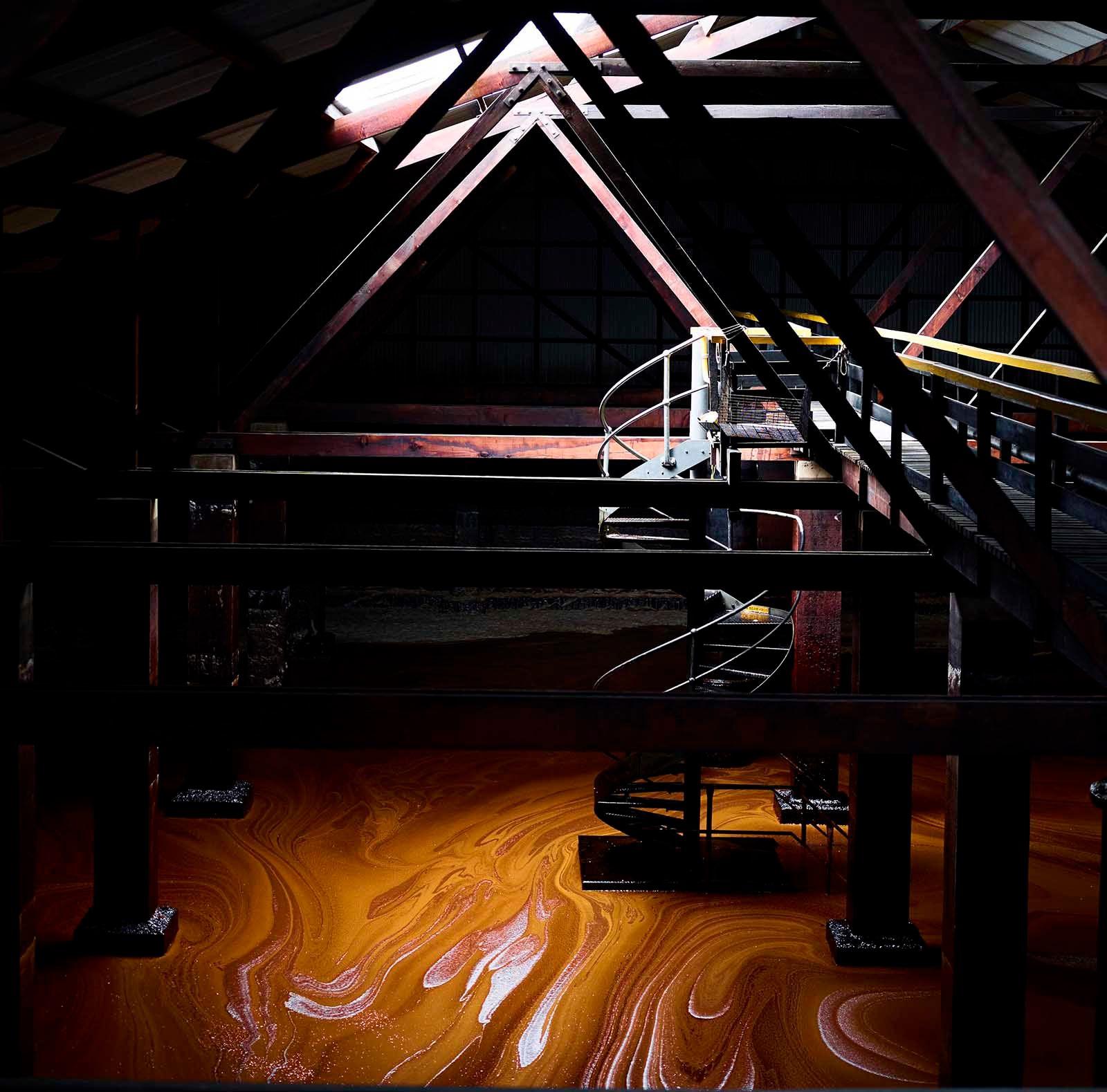

Our new report, commissioned by the Australian Distillers Association (ADA) and Bundaberg Rum outlines the $1 billion export opportunity for Australia’s spirits industry. While Australia has the right building blocks for developing a strong spirits export industry, it's not reaching its potential. The report identifies the key barriers holding the industry back from as well as the steps which can be taken to realise this $1 billion opportunity. Growing the spirits industry will contribute to national economic priorities of growing manufacturing jobs, supporting small business, empowering regional communities, creating export opportunities, generating tourism and supporting diversity and young people.

The economic benefits of Australia’s spirits industry reflect many of our national economic priorities.

The spirits industry supports 7,600 jobs in spirits manufacturing and wholesale, contributing almost $1.2 billion in GVA annually.

The benefits of the industry reflect many of our national priorities including jobs in manufacturing, small business, regional communities, tourism, diversity, and young people as well as creating opportunities for export.

Despite this, exports have room to grow. Australian spirits exports rank 29th globally, compared to wine which ranks 6th in the world based on value. In 2022, Australia exported A$210m of spirits, compared to A$2.1b of wine.

Spirits exports could reach $1 billion by 2035 if Australia realised its potential.

We used a gravity model to estimate how far Australia is falling below its potential as a global spirits exporter.

The results show that if Australia’s export potential was the same as the world’s top spirits exporters, exports could be 79% higher and could reach $1 billion by 2035 if this potential is realised.

Our modelling also shows that a lot of Australia’s export potential is not being realised in key markets in Asia such as India which is also seeing a growing middle class and are currently the largest consumers of whisky in the world.

Policy and regulatory barriers, particularly high excise tax, are preventing the industry from reaching its potential.

Modelling shows that the most significant factors impacting our trade potential are alcohol prices and excise tax, along with trade support and conditions, country branding and ease of doing business.

Australia’s excise tax for spirits is one of the highest in the world and is constricting the ability for distillers to attract investment or reinvest in their business to grow.

Some distillers which are at a scale to export are also finding it challenging to expand overseas due to low global recognition of Australia’s spirits, and large costs with marketing abroad. Distillers were also after more tailored government support for exporting.

The Government can help unlock the potential of the spirits industry to capture this $1 billion export opportunity.

Australia’s spirits industry is at an inflection point. There is growing global demand for premium spirits, including in neighbouring countries in Asia, and a large base of small distillers looking to scale.

To realise this opportunity the industry will need support to attract investment, build industry capability, streamline regulation and access markets. This will in turn deliver significant benefits which are aligned with national economic priorities.

Lessons from the Australian wine industry, as well as in the UK and Japan, show that a freeze on the excise tax and consideration of broader tax reform, as well as establishing ‘Spirits Australia’ are two immediate steps the Government can take to generate significant value for the industry.

Tax reform has been shown to be an effective lever. Wine exports more than doubled in the first five years after the Wine Equalisation Tax being introduced.

A freeze on excise tax would allow distillers to reinvest in their businesses to scale, with learnings from the UK showing that there could be marginal impacts to tax revenue.

Wine Australia as well as examples from Japan also showcases how partnership between government and industry can help an industry grow and provides a model for establishing ‘Spirits Australia’ for the spirits industry.

These actions in combination with other initiatives would help set the industry on a path to becoming another Australian export powerhouse, just like our wine industry.

Download the full report here.

Read our latest posts

Restoring affordable access to specialist care in Australia

In this report, Mandala and Private Healthcare Australia (PHA) studied the affordability of specialist care in Australia. We find that specialist fees are rising, exacerbating cost-of-living pressures on consumers and worsening the affordability of healthcare. We propose a targeted package of measures to improve consumers' ability to access high-quality care, of their choosing, at fair and transparent costs.

3 Feb, 2026

Critical Minerals Strategic Reserve Design

Mandala's latest report for the Association of Mining and Exploration Companies (AMEC) sets out an industry-informed approach to implementing Australia’s Critical Minerals Strategic Reserve, with a focus on rare earths critical to national security and the energy transition. Bringing together 10 Australian rare earth developers, and drawing on international precedents and economic analysis, the report recommends a commercially viable and fiscally sustainable model to support new investment in Australia’s rare earths sector while managing risk to taxpayers.

12 Jan, 2026

The Value of Online Payments to New Zealand Businesses

Mandala partnered with Stripe on a research report based on the findings of a survey of 200 New Zealand businesses around the value of online payments and opportunities for future innovation.

18 Dec, 2025

Optimising Australia’s Specialist Investment Vehicles for the Net Zero Journey

Mandala, in partnership with IGCC, explores how Australia’s Specialist Investment Vehicles (SIVs) are deploying public capital to accelerate the net zero transition. The report examines the current funding landscape, identifies structural challenges that limit the effectiveness of public investment, and sets out a pathway to evolve the SIV system into a more coordinated, capital-led model aligned with national priorities.

10 Dec, 2025